As the global economy pivots from pandemic to recovery in 2021, consumer behaviour and purchasing power remain highly dependent on economic realities, and so understanding factors impacting the economic and financial landscape is more important for business strategy now than ever.

Euromonitor identifies uneven Coronavirus (COVID-19) economic recovery, rising public debts, globalisation reset, higher value-added activities and shifting market frontiers as the five key factors that are shaping the new global economic era.

Keeping up with these trends as they evolve beyond the pandemic will help businesses identify risks and new opportunities in order to adapt and move forward with a stronger strategic direction.

Uneven COVID-19 economic recovery

The global economy is expected to rebound in 2021, with real GDP growth of 5.9%, driven by stimulus spending, COVID-19 vaccinations and improved consumer and business confidence.

The path of recovery, however, remains uneven for countries across the globe, due to differences in infection control, vaccination speed and stimulus scale. While the US economy is expected to return to pre-crisis level in 2021, the eurozone would fully recover a year later in 2022.

Within nations, the speed of recovery may also differ between generations and income groups as they were unevenly impacted by the economic recession. Businesses will thus need to keep track of the macroeconomic environment and carefully evaluate the income and spending dynamics of their targeted consumer groups in order to come up with appropriate pricing and value strategies for their products and services.

Rising public debts

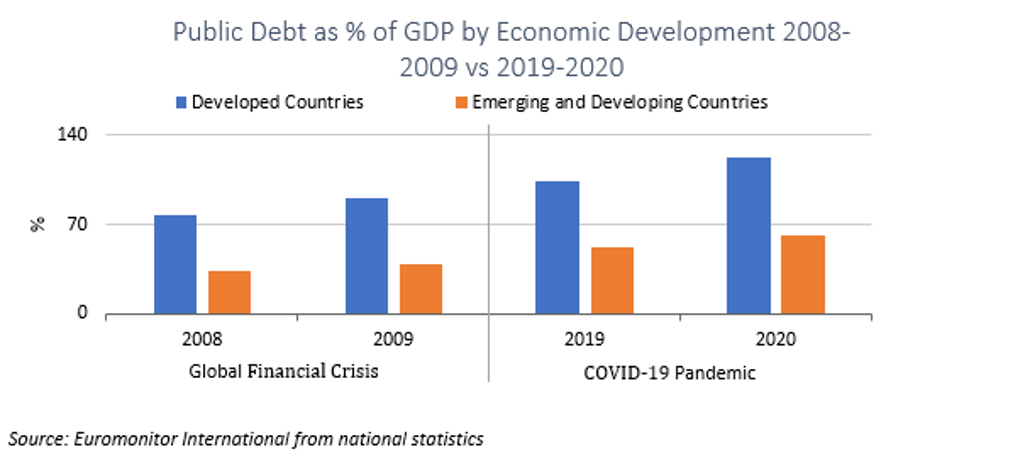

Across countries, public debt increased faster in 2020 amid the pandemic than during the 2008-2009 Global Financial Crisis. Though a rise in government spending is good during an economic slowdown as it helps boost the economy, a long-term high debt level will pose a significant challenge to vulnerable developing and emerging markets that have large financing needs.

As a debt spike can lead to lower government spending and higher financing cost, businesses and consumers in debt-laden countries, such as South Africa, India and Brazil, will be negatively impacted post-pandemic.

Globalisation reset

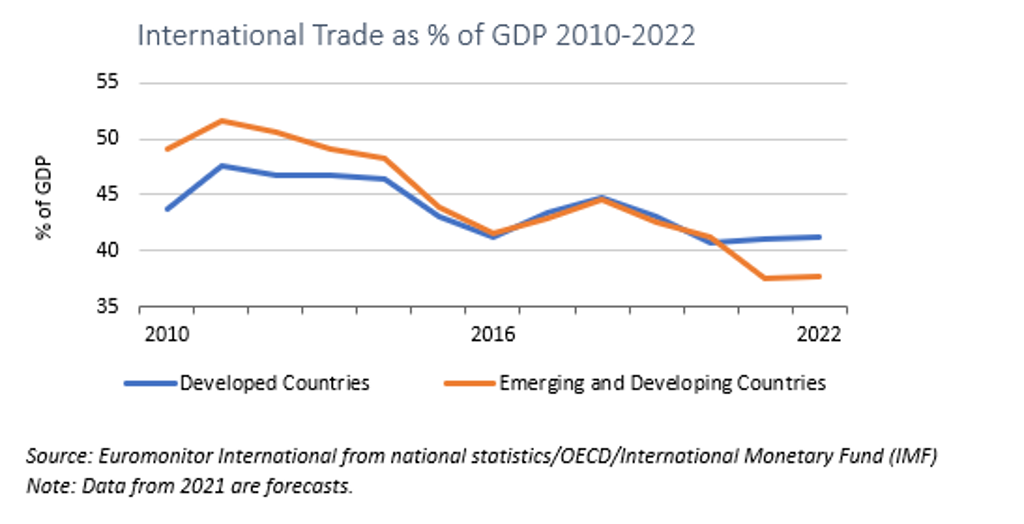

Even before the COVID-19 pandemic, globalisation was in the midst of a profound change, driven by technological developments, diverging growth paths between developed and emerging economies, and the rise of geopolitical uncertainties that boosted nationalism and protectionism trends.

Furthermore, global trade and multinational businesses have been put under stricter scrutiny as consumers increasingly request more transparent and socially responsible supply chains for goods.

The pandemic has given a shock to the global supply chain and revealed its fragility. In 2020, global exports dropped by 7.2% in US dollar terms, while supply bottlenecks hit a variety of industries from retailing to manufacturing. Governments now seek more control over critical supplies like medicine and medical equipment, while companies aim to create greater resilience in the supply chains.

Samsung is shifting much of its display production from China to its plant in southern Vietnam, and Walmart plans to invest heavily in its US local production over the next years. How globalisation will transform beyond the pandemic will thus impact the global manufacturing, retailing and consumer landscape.

Higher value-added activities

Developing and emerging economies continue to shift away from primary industries to higher value-added activities in the global supply chain. The share of the service sector to GDP in India increased significantly from 49% in 2010 to 55% in 2020.

The expansion of service industries, such as retailing, finance, education and hospitality, has contributed to increased incomes, enabling consumers to spend more on non-essential goods and services.

With retailers and consumer goods companies no longer having to depend on physical stores to reach end-consumers, e-commerce is leading the revolution in the services industries, particularly in emerging economies, such as China.

The beverage company Starbucks, for example, signed a partnership with Chinese e-commerce giant Alibaba in 2020 to expand its delivery services to 2,000 stores in 30 cities across China. Consumers are likely to continue to favour e-commerce after the pandemic.

Shifting market frontiers

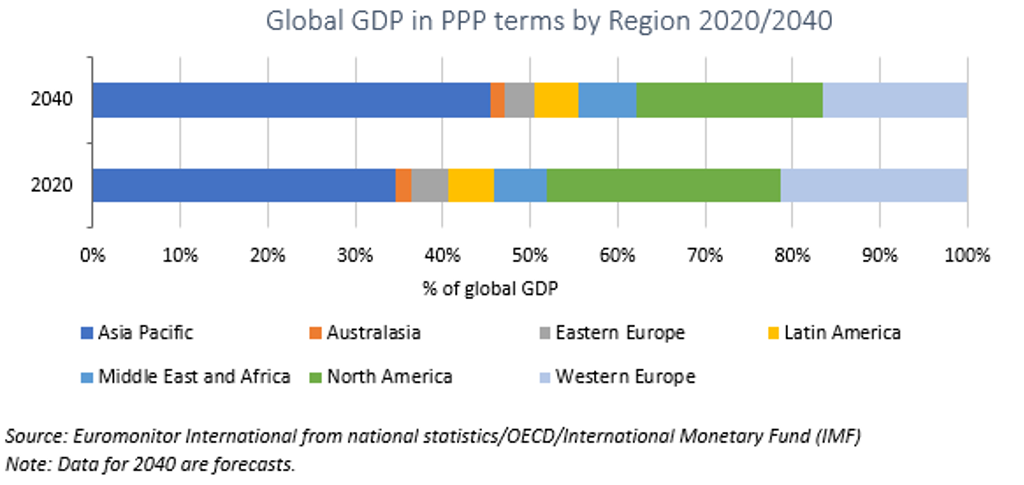

Despite rising debt risks and uncertain recovery paths, emerging economies will remain the principal drivers of global economic growth in the long term. Between 2020 and 2040, 75% of the global GDP growth will come from emerging and developing markets, bringing up their share in the global economy in purchasing power parity (PPP) terms to 69% by 2040 (up from 56% in 2020).

The long-term shift of economic power to emerging markets will continue to present strong growth opportunities for companies and brands looking to expand their customer base in less saturated markets.

Given its sheer size and positive economic outlook, Asia Pacific remains the most attractive market for businesses.

In a bid for global domination of the world’s streaming markets, Netflix is increasingly tapping into emerging Asian markets such as Indonesia and the Philippines, driven by the region’s young demographic, digital savviness and burgeoning middle-class. African economies and consumers will also play a bigger role in the global economy.

The number of middle-class households in Nigeria, for instance, will double between 2020 and 2040, to reach 17.4 million by the end of the period. Global businesses in various sectors, from digital finance to education and healthcare, are increasingly targeting African new middle-class, urban consumers.

Learn more by watching our on-demand webinar, Global Economy in 2022: Getting Back on Track with Challenges Ahead.