Tech advances are shaping consumer attitudes, enhancing shopping experiences and altering the path to purchase. The Coronavirus (COVID-19) pandemic is accelerating the digital shift, underscoring the importance of tech in consumers’ lives, as well as business operations, to quickly adapt and stay connected in unprecedented conditions.

Euromonitor International’s new 2020 Digital Consumer Survey captures the role and influence of technology on commerce, tracking consumer behaviour, motivations and values. Fielded in March and April 2020, this survey and the insights below reflect consumer sentiment while mandated lockdowns were in place around the world during the COVID-19 pandemic.

35% of consumers prefer contactless in-store shopping features

Contactless retail has emerged as a key trend during the pandemic to reduce the risk of virus transmission. The initial outbreak drove a renewed push towards contactless options in payment, ordering and delivery. Even while shopping in-store, consumers report the strongest preference for the two checkout experiences that most reduce human interaction.

Globally, 35% of connected consumers pointed to scan-as-you-go and walk-in, walk-out technologies, both of which eliminate interaction with store associates, as the top-two options that would improve their in-store experience. Tech-forward checkout experiences were already being integrated in particular formats, such as convenience stores, so such concepts will likely receive a long-term boost from the pandemic.

Products being out of stock is the biggest challenge when connected consumers use click-and-collect services

Delivery and logistics are now competitive fronts for retailers and third-party delivery platforms. The boom in e-commerce and rising last-mile delivery costs that cut into margins are forcing retailers to explore alternative pick up options, such as click and collect. Consumers have become even more reliant on such services given social-distancing measures, with one-quarter viewing click and collect as an important delivery feature.

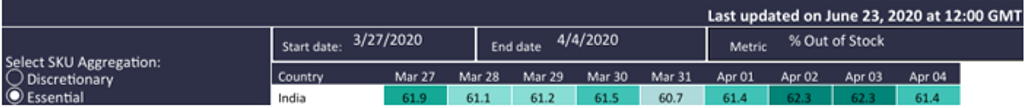

Syncing in-store inventory management systems with e-commerce operations remains a key challenge for retailers offering click-and-collect services. Skyrocketing demand for certain products and stockpiling magnified this disconnect during the pandemic. One-third of connected consumers report out-of-stock products as the top challenge when using click-and-collect services, with the highest sentiment coming from emerging markets. In India, for example, more than 60% of essential* online product SKUs were out of stock from 27 March through 4 April, consecutively.

Source: Euromonitor International’s Pricing and Availability Tracker

Out-of-stock rates will subside as lockdowns ease. However, out-of-stock products will remain a key challenge for consumers using click-and-collect services. Retailers often fulfil these orders from store shelves, which makes tracking real-time inventory difficult.

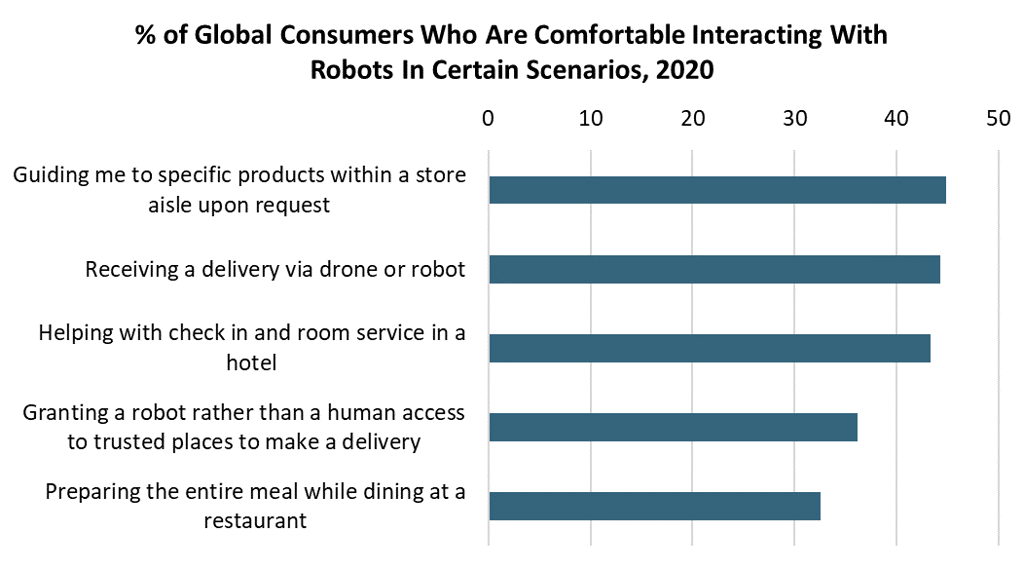

At least one-third of connected consumers are comfortable interacting with robots

Robots can be used across the entire retail ecosystem. Given heightened health concerns due to COVID-19, businesses have been exploring the use of humanoid robots more recently to eliminate human-to-human contact in transactions.

Of the five scenarios provided, connected consumers are most comfortable with robots guiding them to products in a store aisle (45%) and least comfortable with robots preparing an entire meal while dining at a restaurant (33%).

Source: Euromonitor International’s 2020 Digital Consumer Survey

High levels of consumer openness, as well as the pandemic, will likely drive a continued interest in robots among retailers, restaurants and hospitality operators to help reduce operating costs, minimise human interaction and boost customer engagement. Reducing operating costs, in particular, could provide robots with longer-term potential over another tech like augmented and virtual realities. However, businesses will need to conduct a cost-benefit analysis to determine viability in the long term.

Half of consumers use a mobile app to pay for online groceries

Obtaining groceries without stepping foot into a physical store has become crucial for consumers in lockdown. French retailer Carrefour reported that vegetable deliveries increased by 600% year-on-year during the Lunar New Year period in February, while Chinese online retailer JD.com reported its online grocery sales grew by 215% year-on-year during a 10-day period between late January and February.

When looking across online purchase channels, 31% of global connected consumers buy food and beverages on a smartphone, 21% on a computer, 12% on a tablet and 7% on another device. Of these online food and beverage purchases, 50% of global consumers execute payment through a mobile app.

While consumers may still frequent grocery stores and resume old habits, a portion of overall grocery spend will shift from physical to digital channels on a permanent basis even after a vaccine is available. Though consumers will continue visiting physical grocers in the future, a long-term shift in spending should be expected as consumers increase their usage of digital channels.

48% of connected consumers use their phone to order foodservice delivery or takeaway and 57% use a mobile app to pay for their online order

During mandated lockdowns, restaurants closed to eat-in traffic and consumer spending on all foodservice fell dramatically. Delivery and takeaway services emerged as lifelines for many operators. Almost half of connected consumers reported ordering foodservice for takeaway or delivery on a smartphone (48%), as opposed to in person at the restaurant (42%). Whether ordering at home, on the go or at a physical outlet, the smartphone became central to operations with 57% of connected consumers using a mobile app, and 40% a mobile website, to pay for an order. In the aftermath of the outbreak, ordering and paying for foodservice via digital channels will only be accelerated due to this period of digital demand.

[embed]https://euromonitorintl.wistia.com/medias/yge6z53hoo[/embed]

Euromonitor International surveyed more than 20,000 consumers globally to understand how technological advances are altering commerce. The Digital Consumer Survey tracks consumer behaviour, attitudes, motivations, values and consumption across topics, including customer experience, delivery and collection, device ownership and activities, digital wallets and payments, emerging technologies, loyalty, path to purchase, privacy and security and social media in 20 countries.

To preview key insights from the latest survey results, download our report extract, “Digital Consumer Survey 2020: Key Insights”.

*A specific basket of FMCG product categories is deemed “essential” based on their econometrically estimated income elasticity of demand and qualitative input from our research teams.