Fashion face masks1 appeared in most consumers’ lives in 2020. In some markets such as Japan, South Korea and China, they were already prevalent, commonly used to avoid the spread of viruses, or due to high levels of air pollution, as in India. But prior to the pandemic, very few other countries typically offered fashion face masks.

However, as the spread of Coronavirus (COVID-19) reached more people, a mix of governmental measures and individual fear led to exponential growth of this fashion item throughout 2020. As many new players address this surge in demand, a new product category has taken form, with its own characteristics that resemble, in part, those of apparel accessories.

1. Fashion face mask - - A washable, reusable cloth face mask made of common textiles, usually cotton, worn over the mouth and nose. Cloth face masks do not provide a seal around the face. Includes only B2C transactions. Excludes: Surgical masks, disposable paper masks and respirators such as N95 masks.

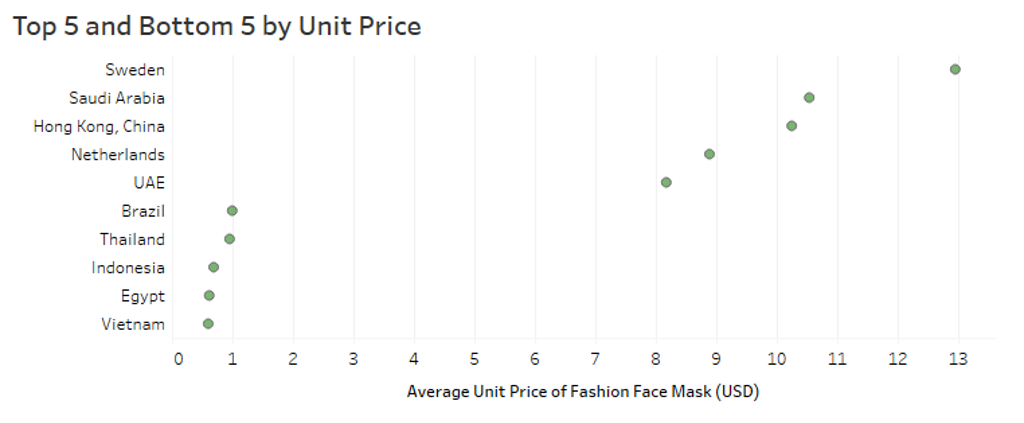

Price variation across the world

Of the 46 markets researched by Euromonitor International, Vietnam has the lowest average unit price for fashion face masks, at USD0.60 in 2020. Egypt and Indonesia follow closely. These countries benefit from an existing manufacturing industry for fashion that was able to adapt and provide such items at low cost.

On the other side of the spectrum, we can find Sweden, Saudi Arabia and Hong Kong leading the ranking of fashion face masks by average unit price. Higher disposable income naturally allows consumers to purchase branded fashion items or to venture into the higher end of the offering.

Luxury and premium alternatives have also appeared fast, with growing appeal to high-income individuals. For example, Burberry offers seven models priced at around USD120 and Dolce & Gabanna has launched a range priced from USD89 to USD122. With high demand and popularity, fake versions have also flooded online retailers, with prices as low as USD10. Face masks had quickly become big business: The e-commerce player Etsy generated USD346 million in sales of fashion facemasks between March and August in 2020.

In the middle price range, consumers can find a great variety of sports-oriented versions of fashion face masks. Under Armour has been particularly successful with its Iso-Chill mask priced at USD30. At the same price, Nike found its place in the market with the Pro Hyperwarm full-face mask. These higher prices reflect extra features imbedded in the mask that appeal to sports enthusiasts, from breathability to dryness.

Fashion face masks to remain relevant

Resistance to wearing masks was common at the beginning of the pandemic. From unfounded health concerns to simple discomfort, face masks in general were avoided by many. Legislation has obliged their use, whether in closed or even open spaces, contributing to substantial increases in percentage use globally. This demand is likely to remain for some time, given the expected longevity of the virus.

While fear of contracting or spreading the virus underlines widespread global adoption, other factors are playing a part, and likely to grow in importance. Air pollution, for example is likely to encourage continued use, particularly in urban areas, and face masks are also quite effective against allergies caused by pollen. Furthermore, to a smaller extent, beyond its practicality and more in a fashion-oriented trend, consumers are enriching their accessories portfolio, adding a new item to their personal style repertoire. For example, fashion face masks became popular in South Korea among teenagers who wanted a mysterious, even intimidating, image or one that allowed them to cover skin complaints.

In the long-term, it is expected that habit persistence will keep fashion face masks in the market for a while. The type of usage will be similar to that established in Asia Pacific. However, demand can be expected to decline as the pandemic is controlled, country-by-country level. Consumers will also prefer increasingly higher quality items as the market stabilises and need for regular usage ceases.

Legislations and restrictions impact consumption

Legislation enforcing the use of face masks has been instrumental in driving demand. As more stringent rules were introduced, usage and demand increased, reflected in a growing range of products available across national markets. In the case of US and France, use of surgical masks was typically restricted to medical staff, giving an additional boost to fashion face masks, driving prices upwards as demand exceeded supply.

Other restrictions have had a negative impact on fashion face masks. For example, in Germany, 2021 started with more rules regarding which types of face masks are allowed in specific circumstances. N95/KN95/FFP2 (filtering facepiece) masks became the norm in public transportation and indoor spaces, reducing demand for fashion face masks. Conversely, in March 2021, the Brazilian Government made disposable masks mandatory, such as those above-mentioned in the German example, allowing fashion face masks with at least two layers to be used.

Therefore, given the better understanding of fashion face masks efficacy now, and given increasing restrictions on the types of face masks allowed in public spaces, it is expected that fashion players will seek certification for their products in order to allow wider usage. Furthermore, such certified products are likely to stimulate demand, with consumers willing to pay a premium for these alternatives.

While the relevance of fashion face masks will remain high in the short to medium-term, usage will depend on the evolution of the pandemic and additional legislation, or the easing of restrictions put in place by governments. Furthermore, as supply and demand adjust in this new and developing category, prices are expected to stabilise, and several players are expected to withdraw from the market. Premium prices will be viable for brands that are able to offer innovation in terms of efficacy, comfort or design.