According to an Estée Lauder Companies Inc press release published on February 23, 2021, US-based Estée Lauder Cos Inc is increasing its investment from a minority stake to a majority stake in Deciem Beauty Group Inc, a Canada-based company whose leading brands have disrupted the US, UK, and Canadian skin care markets over the past five years. Estée Lauder Companies Inc also voiced its intent to fully acquire the company in or after 2024.

Photo of Deciem’s brand The Ordinary. Source: Estée Lauder Companies via Business Wire

Deciem houses several brands, such as Niod, Hylamide, and Abnomaly. However, it was The Ordinary that propelled the company’s fast growth and solidified its position as a disruptive skin care brand with a noteworthy cult-following. Known for results-driven solutions and more simplified and ingredient-led narratives, The Ordinary sits in an increasingly blurry but attractive space in skin care: masstige.

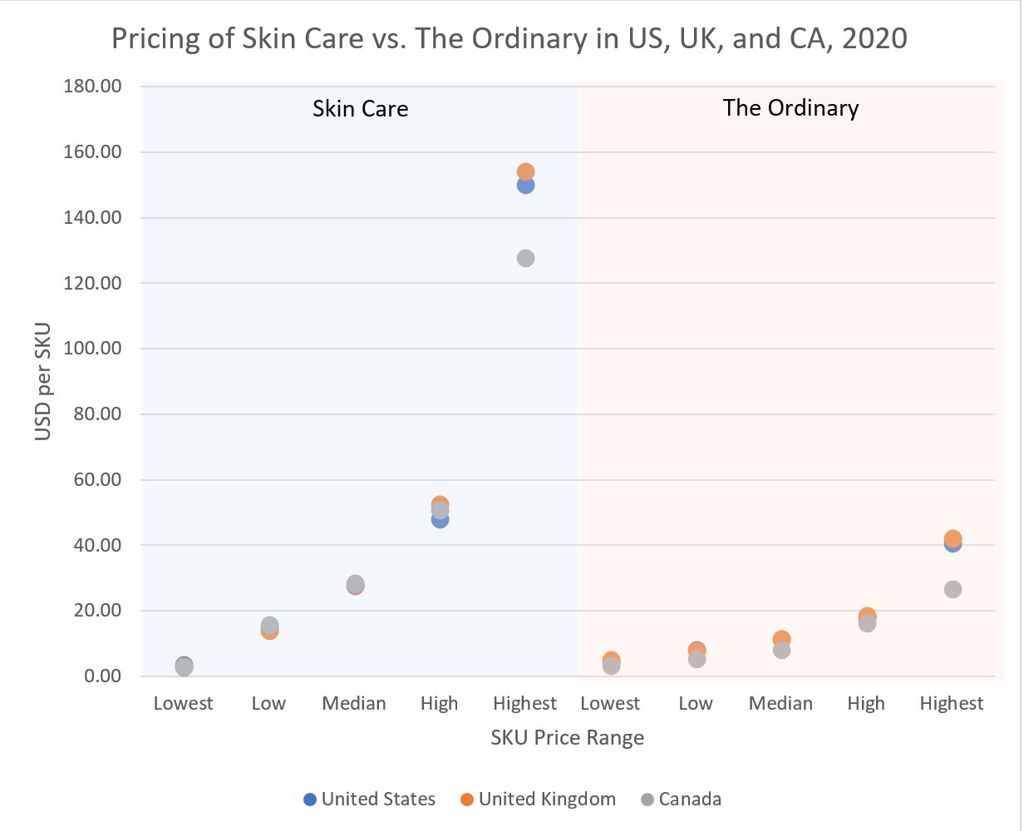

The masstige category of skin care brands was attractive, even pre-COVID. Brands in this category position themselves as having the benefits and qualities similar to premium skin care, but at a more accessible price point (at the high-end of mass brands). Analysis from Euromonitor’s Via Pricing system revealed that the median price range of The Ordinary reached USD10.18 in 2020, almost half of the median price range of total skin care, USD28.05 in 2020.

Source: Euromonitor International Via Pricing sample, 1 January 2020 to 31 December 2020.

Timing of trends also propelled the popularity of masstige skin care, since the "clean beauty" movement helped usher in characteristics considered premium (e.g. vegan, paraben-free, etc.). At the same time, beauty consumers widened their basket of skin care brands as they shift some of their dollars away from colour cosmetics. Combining those factors with COVID effects of cautious consumer spending and shifting channel dynamics that benefit mass retailers, masstige skin care becomes an interesting, compelling cocktail that could potentially convince consumers who have traded down from premium skin care or traded up from mass skin care to stay.

Retailers played an important role in the growth of masstige skin care. Grocers like Whole Foods and mass merchandisers like Target have, in recent years, grown their portfolio of masstige lines with an ingredient-based ethos. This strategy helps masstige skin care seem accessible and approachable, while also delivering on leading skin care attributes sought out by consumers, such as value for money (desired by 33.2% of global consumers in 2020), high quality (27.0%), functions and/or benefits (22.8%), and low price (20.8%).*

Other investment targets in masstige skincare include LVMH's investment in Versed, which also sells in Target. The Target-Ulta Beauty and Sephora-Kohl’s retail partnerships in the US also foretell enduring growth in masstige lines. The growing prominence of clinical skin care and ingredient-led narratives supports the potential of masstige skin care, as consumers look for high efficacy, seek out better quality over than quantity, and experience current price sensitivity. Deciem’s The Ordinary has been one of the frontrunners in the area of ingredient transparency and education, which instils greater credibility in product efficacy and perceptions of higher quality, while not at the expense of a higher price tag.

At a time when prospects for the masstige segment are becoming more lucrative and price sensitivity has become more prominent as a result of the pandemic, the beauty industry is likely to see more and more prestige players diversify and expose their brand portfolio to brands across the whole price spectrum and those targeting a more varied consumer base.

This acquisition could also spell the beginning of a pattern in which beauty players acquire a minority stake in a company before a complete acquisition, a strategy Estée Lauder Cos Inc employed with Korean skin care brand Dr. Jart+. This cautious approach contrasts starkly with the rapidity of acquisitions during the hyper-cycle of beauty consumption from 2012 to 2017. Given Estée Lauder Cos Inc’s February 24, 2021 announcement that cosmetics brand BECCA will close down September 2021, a pivot to skin care acquisitions that take place in phases is expected while the industry grapples with a struggling colour cosmetics market.

*Source: Euromonitor International Beauty Survey, 2020