Consumers increasingly value functionality in their food. A number of emerging trends in this area are gaining traction, even though scientific evidence to support the link between certain ingredients and health benefits is often scarce or too early to assess conclusively. Consumer beliefs and perception therefore play a huge role in the success of products with functional claims.

Food as medicine is thriving amidst Coronavirus pandemic

Health has become top of mind for consumers as a result of the Coronavirus (COVID-19) pandemic, with people taking greater ownership of their health and putting a much stronger focus on preventative health measures. Many are choosing natural solutions over vitamins or other supplements. This opens opportunities for manufacturers of functional food that provide health benefits beyond basic nutrition. In particular, functional ingredients that help to boost immune support have moved into the spotlight and are spurring product innovation.

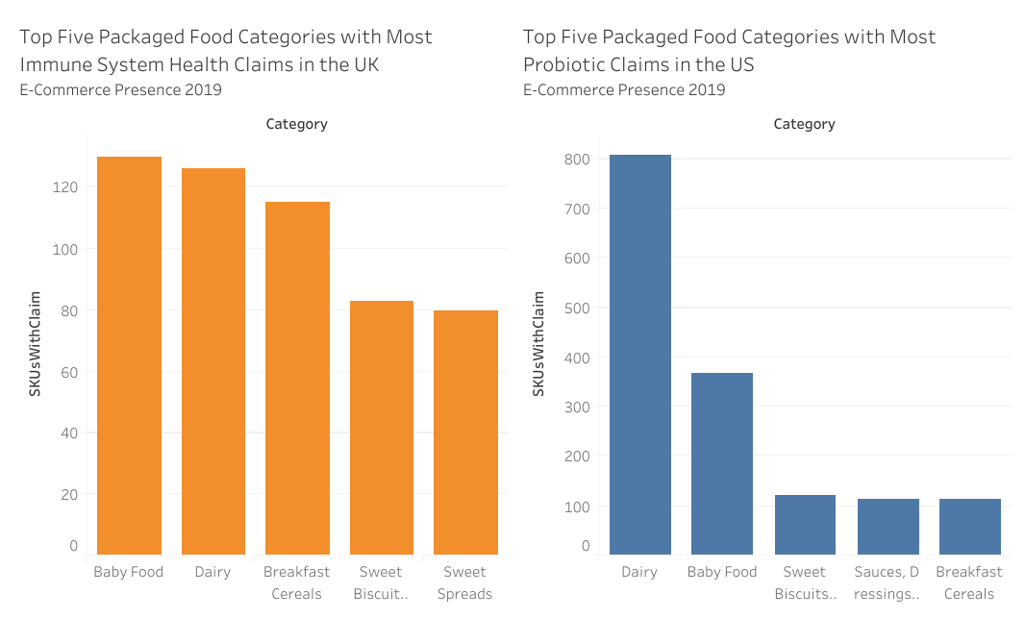

Products that include probiotics, added vitamins or natural ingredients such as ginger, rich in antioxidants and traditionally used as a home remedy, are currently being sought out by consumers. But even ingredients such as beta glucans, which is a component of dietary fibre, are experiencing a move from supplements into packaged food. Beyond baby food, dairy, breakfast cereals and sweet biscuits, snack bars and fruit snacks are the categories that show the most potential for immunity-boosting positionings in markets such as the UK and the US.

Source: Euromonitor International

Beyond immune system support is the concept of gut health. This has gained in popularity over the past year, opening growth opportunities for functional products with fibre, pro- and prebiotics to support a healthy gut. Fermented products that naturally contain beneficial bacteria such as kefir and kombucha have seen staggering success in North America and some Western European markets. In the UK, for example, kefir products have driven double-digit growth rates for sour milk products in 2019 and 2020. One brand driving innovation is Biotiful Dairy which expanded into new categories in 2020 with the launch of kefir soft cheese and kefir frozen dessert.

Addressing consumer need states with functional claims

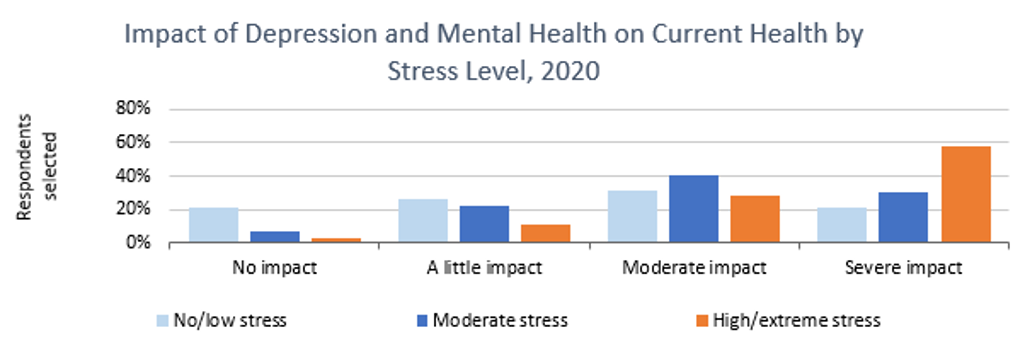

According to Euromonitor International Survey data, 73% of global consumers are concerned that stress and anxiety have a moderate or severe impact on their health. The current health crisis has exacerbated certain need states of consumers. Stress and anxiety, for example, not only affect emotional and mental wellbeing, but often also result in sleep deprivation. Thus functional food that helps consumers relax or to manage/lift their mood is expected to do well. This opens new opportunities for cannabis in packaged food, with rising consumer acceptance on the back of growing demand for more natural active substances and rapidly evolving legislation. Snacks, baked goods and dairy are expected to show the greatest potential.

Source: Euromonitor International Health and Nutrition Survey, fielded February 2020, n= 3,821

Other emerging trends within functional food include products with energy-boosting properties, nootropics that help consumers to be alert and focus, sleep-friendly ingredients that aid sleep and edible beauty with ingredients such as collagen linked to hair, skin and joint benefits.

Quality of protein increasingly moves into the spotlight

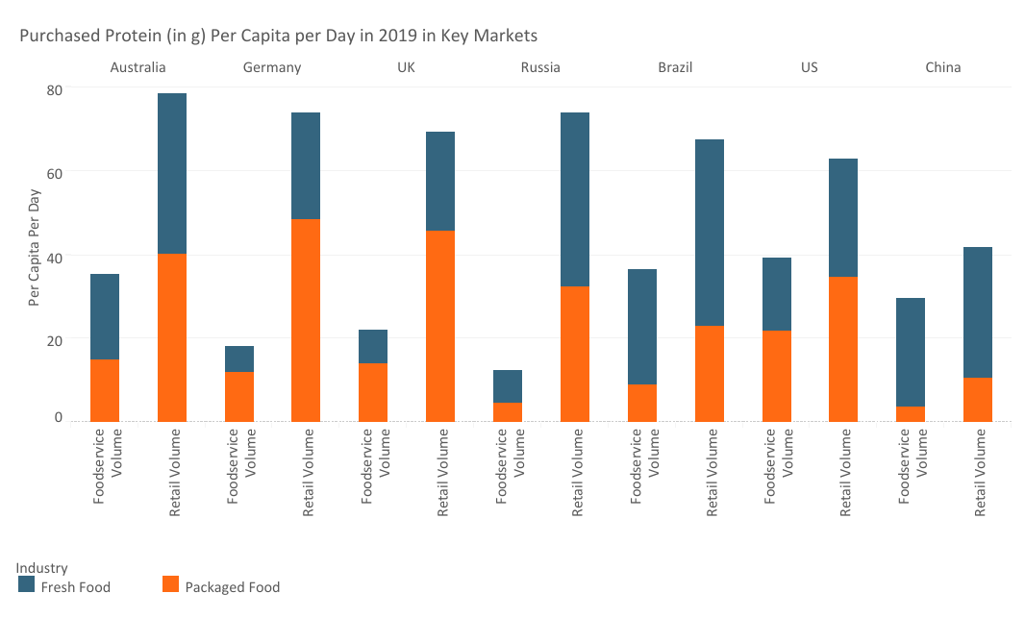

Even though protein tends to be overconsumed in many Western markets, it remains one of the key functional nutrients for packaged food companies and consumers alike. The recommended dietary allowance amounts to 0.8g of protein per kilogram of bodyweight which translates to around 50g per day for an average adult.

Source: Euromonitor International

The discussion around protein, however, is increasingly moving from a quantitative to a qualitative angle. Health and sustainability reasons drive consumers to focus more and more on the delivery of plant-based rather than animal-based protein. Pea protein, for example, is one of the most in-demand plant proteins at the moment and has made its way into numerous new product launches across meat substitutes, yoghurt and ice cream, thanks to its high protein content and sustainable properties.

Sustainability plays a key role for product innovation in this space, with the potential to disrupt traditional animal-based protein sources in the future. While US-based start-up Plantible Foods has explored an aquatic plant known as duckweed as the next generation of plant protein, Finnish start-up Solar Foods has developed a new kind of protein produced from renewable electricity, water and air. Both claim a competitive advantage via sustainable sourcing, neutral taste and high protein content.

Opportunities and threats

The emerging trends in functional food are likely to provide growth opportunities as they tap into consumers’ needs, many of which have been exacerbated by the COVID-19 pandemic, as they are related to preventative health, stress, anxiety and mental wellbeing. However, while consumers might see added value in health benefits of functional food, growth may be threatened by increasing price sensitivity as a result of the economic recession in 2020, which makes affordability a key purchase criterion.

More detailed insights on the potential of functional food are available in our Functional Food and Growing Importance of Labelling briefing.