Inevitably, the drinks industry has been severely disrupted as a result of the Coronavirus (COVID-19) pandemic. The closure of on-trade and measures encouraging more at-home consumption have resulted in the collapse of high margin categories such as draft beer, fountain soda and spirits, as well as impulse and small format items within soft drinks.

Unemployment and bleak economic prospects mean that innovation is either on hold or being reconsidered, as consumers look to trade down or trade across. Although a vaccine in 2021 promises some return to normality, some aspects of consumer behaviour will be permanently altered. Manufacturers who can adapt to restrictions and diminished or changing occasions for drinking will succeed in driving future growth.

E-commerce adoption speeds up, but what happens in 2021?

Neither soft drinks nor alcohol have fully benefited from the boom in meal delivery apps in Latin America. A full-service restaurant might expect alcoholic drinks to represent 33% of its revenue, but in the rush to e-commerce and delivery at the beginning of the pandemic, drinks were overlooked: only 5% of all foodservice delivery orders in Latin America included a drink before COVID-19, according to industry sources.

Producers should focus on new, higher margin pack types and multipack options exclusive to last-mile players such as Cornershop, and seriously consider whether it’s in their best interests to partner with a delivery app such as Uber Eats or Rappi to expand their delivery or to launch a dark kitchen. High commissions, a limited delivery radius and the outlet losing control of the online business are all factors in a Mexican national survey from July 2020 showing that around 7 out of 10 foodservice members were not satisfied with the service offered by digital platforms and consider that the commissions charged are too high.

Takeaway and delivery will likely remain relevant to some degree, post-pandemic, so beverage companies need to find ways to get their products into these orders. This might include hyper-local RTD cocktails, meal bundles or discounted food and beverage combo items. For example, Glovo, a popular delivery app in Peru recently allied with Arca Continental to launch Inca Kombos (discounts in foodservice orders including a free bottle of Inca Kola) as part of a reactivation initiative.

Social initiatives align the drinks industry with new consumer values

A renewed focus on national pride coupled with the need to support local business as part of purpose-driven strategies following the pandemic, has motivated manufacturers such as Grupo Modelo in Mexico and Abinbev in Brazil to create initiatives supporting local restaurants and stores. These initiatives maintain brand relevance without conflicting with various municipalities, such as in Mexico and Ecuador, that discourage drinking alcohol during lockdown.

Conversely, certain players have been associated with social responsibility simply by continuing operations. Tequila and mezcal in Mexico and cachaça in Brazil are examples of industries that are the lifeblood of local communities. This increased attention to locally-produced heritage products is likely to continue shaping consumer behaviour even after the pandemic.

| Top Priorities from Global Food and Beverage Players | % of Respondents who Agree |

| My company is supporting employees during COVID-19 | 84% |

| My company is supporting local communities during COVID-19 | 55% |

| My company is supporting suppliers during COVID-19 | 52% |

Source: Euromonitor Voice of the Industry Sustainability Survey (2020)

Trading down becomes the number one priority for consumers

According to the International Labour Organization (ILO), in Latin America, nearly half the working population operates in the informal sector, which has been severely impacted by a reduction in foot traffic. These workers live hand to mouth, and so the stay-at-home creed has never been a real option for them. These workers also often lack the welfare programs that have been implemented in the US or Western Europe. Latin America’s real GDP for 2020 is projected to contract by 8.4% year-on-year, compared to 8.9% in Western Europe and 4.2% in North America.

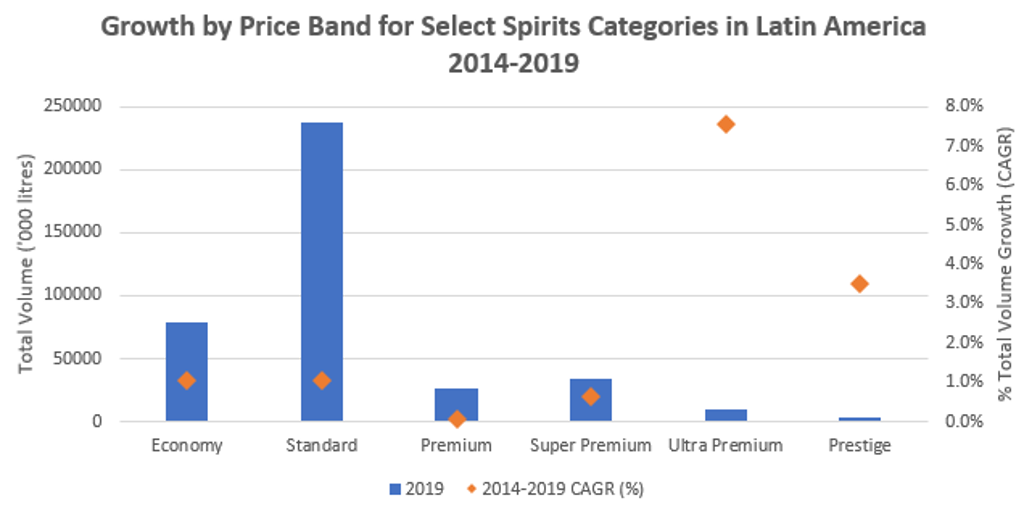

The 10-year movement towards craft and premium products across categories will also take a back seat in Latin America as consumers trade down to lower priced beverages due to lost income. Economy staple brands are best placed for growth in 2021. Within spirits, local spirits such as charanda and aguardiente will see gains as a direct result of trading down.

Source: Euromonitor International. Note: Includes white/dark rum, other blended whisky, vodka and gin.

From high-energy discotecas to afternoon spritz

In 2020, the alcoholic drinks industry in Latin America is expected to decline by 11% in total volume sales. The absence of social events and normal levels of tourism, coupled with the ongoing threat of a second or third wave means, these trends will continue into the first trimester of 2021. In addition, according to Euromonitor International, roughly 450,000 consumer foodservice establishments are expected to close permanently, restricting locations for socialising.

Spirits that are associated with night-time occasions - pisco, rum, vodka, whiskey, cachaça, and tequila, for example - have been severely impacted by bar closures. The industry wonders how much of the late-night Latino culture will be lost to the emergent new normal.

For example, years after becoming a mainstay in Europe, the Aperol or Ramazzotti spritz trend is increasingly common across Latin American cities. Moving forward, categories associated with consumption opportunities during the afternoon and early evening - barbecues, festivals, music, art - might find an opportunity for growth. The hard seltzer trend looks to capitalise on consumers looking for something new after a year in lockdown drinking the same thing. Look out for Coca-Cola´s first foray into the alcoholic drinks industry with Topo Chico in Mexico or CCU´s Hard Fresh by Mistral Ice in Chile.

For more insight into strategies for adapting to the post-pandemic drinks landscape, check out Post-Coronavirus Learnings from Spirits in Latin America and Raising a Glass to the Post-Pandemic Consumer.