As in all other retail channels, direct selling sales have been directly impacted by the Coronavirus (COVID-19) crisis, with players forced to redesign strategies and quickly implement changes. The pandemic came at a time when direct selling was already facing challenges. Amidst the merciless digitalization process the retail industry has been undergoing in recent years, direct selling companies face two obstacles: to attract customers and shape their shopping experience around the consumer’s own convenience, while ensuring sellers retain the key role they play in making this channel so unique. In the context of the COVID-19 pandemic, it has been no different.

In this context, most prominent direct selling players have launched multiple digital strategies, set to work in a complementary way with the role of sellers. This guarantees the digital footprint that helps provide a more consumer-centred shopping experience while preserving the importance of its network of sellers.

However, in order to ensure that sellers remain engaged and motivated, companies have seen another double-edged challenge. One is attracting younger demographics to become sellers, as the role of the sales representative is still often seen as an outmoded job, while the other is competing with gig economy players for workforce.

Social distancing drives digital strategies

The face-to-face appeal that makes this channel so unique was directly hit by the COVID-19 pandemic, as a result of the temporary closure of schools and offices, as it is common that sellers are work colleagues or school friends of customers. With the adoption of social distancing measures, demonstration meetings have been discouraged as well. In this context, leveraging digital tools typically associated with e-commerce, such as live streaming, has proved effective for players like Amway in China.

Still, sellers have been encouraged by direct selling companies to strengthen their relationships with customers through social media and messaging apps to make the process of making orders of products where purchases are recurring, uninterrupted and more seamless. Yanbal, for instance, launched Yanbal Delivery in Peru, where sellers receive orders from their customers via remote channels such as WhatsApp and place them through a mobile application. The order is then shipped directly to the customer’s door instead of being delivered face to face by the seller, in a strategic response by the company to comply with social distancing measures. E-commerce has gained relevant traction too, with direct selling players reporting a growing number of customers placing orders online for the first time. For instance, in Brazil, Boticário group reported more than 30% growth in the number of customers new to the group’s online channels.

Also, amidst such an unprecedented sanitary crisis, direct selling companies have acknowledged the need to revise their product strategy to respond to consumers’ new, urgent demands. For instance, direct selling players in the beauty and personal care space like O Boticário, Avon and Natura have focused on the production and retailing of products related to COVID-19 prevention, such as hand sanitisers and face masks. Adapting product and service portfolios to suit consumers’ new needs, while embracing emerging e-commerce tools and social media have proven key to driving sales. At the same time, putting sellers front and centre via digital platforms and professional development initiatives has been increasingly important to guarantee an engaged workforce of representatives.

Digital engagement and perks to sellers will spur recovery

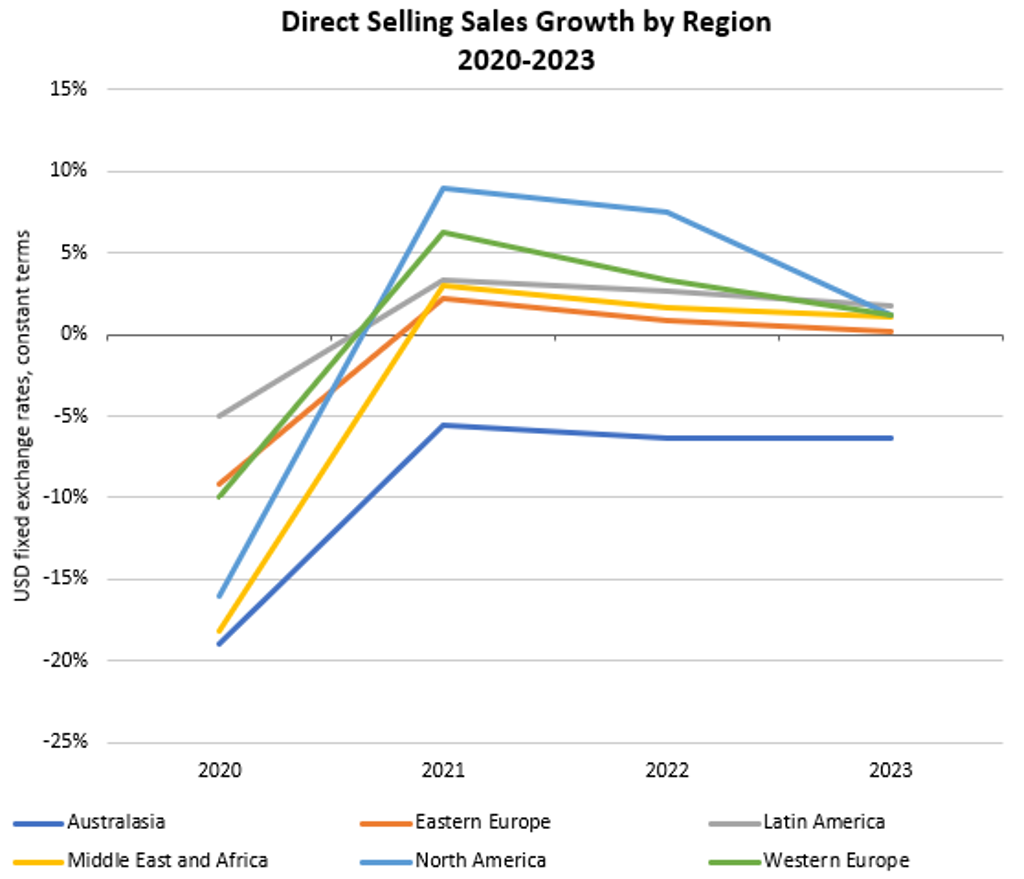

The recovery should come quicker where the face-to-face appeal of direct selling plays a key role, such as in Latin America and North America, with Brazil and Mexico expected to post some of the largest absolute growth across the globe through 2024. The US is set to remain the largest market worldwide, accounting for nearly 20% of direct selling sales in fixed 2019 exchange rates (USD constant 2019 prices) in 2023.

Source: Euromonitor International. Note: Data is forecast.

From customers’ perspective, digital strategies such as e-commerce and distribution of catalogues via social media and WhatsApp will continue shaping the relationship between customer and seller and lead direct selling companies to review their relationship with other links of the value chain, such as printing companies.

As for sellers, with most markets expected to face a deterioration in employment levels amid COVID-induced recession, unemployed workers will seek alternative ways to guarantee household income, which is expected to increase direct selling companies’ workforce of sellers. However, direct selling companies might compete for workforce with gig economy players such as Uber and last-mile delivery apps, as the network of sellers reaches a more balanced split between female and male representatives and gradually leaves behind the idea of a seller as typically a female role. In that sense, the promotion of strategies aiming at the professional development of sellers will prove key to attract and retain sellers in a post-pandemic world.

The global recession in 2020 will result in lower income levels across countries. In that context, digitalization will prove key to boosting impulse purchases and bringing the customer and seller even closer together. However, the same digitalization that engages customer and seller will cause the relationship with other links of the value chain to be permanently changed.