A version of this article originally appeared in the Digestive Health digital issue of Natural Products INSIDER.

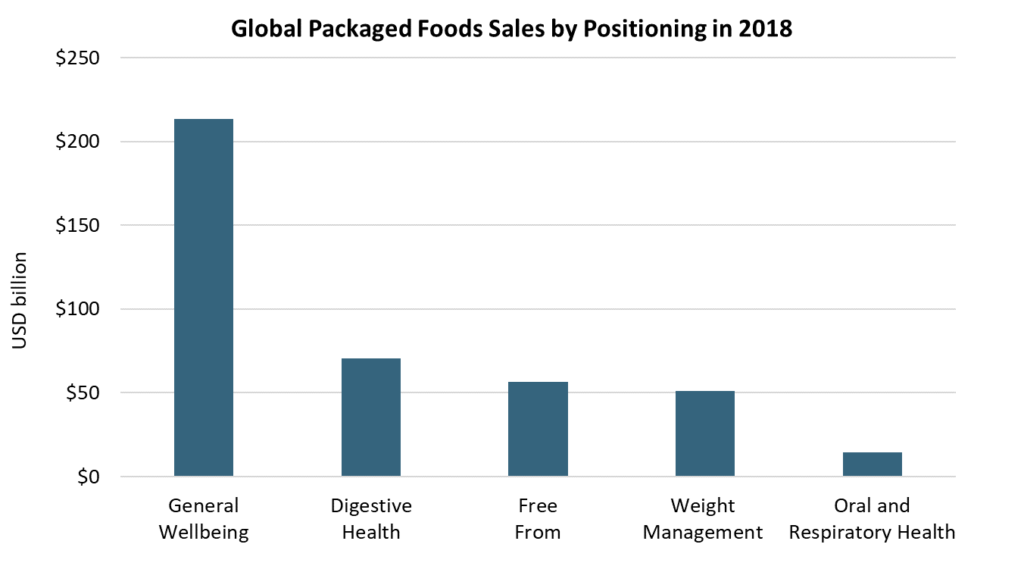

Digestive health is one of consumers’ top health concerns. According to Euromonitor International, foods with digestive health as their prime positioning accrued sales of USD70.5 billion in 2018 globally, making it the second-largest positioning platform behind general wellbeing.

Source: Euromonitor International

At the same time, food intolerance, food allergies, irritable bowel syndrome and other chronic diseases continue to rise dramatically. Though aware of digestive health, consumers know little or are starting to learn more about the complexity of the gut and its true role in the rise of these health conditions.

The free-from movement continues to lead the way in digestion

The free-from movement is strongly related to digestive health. As the number of allergies and intolerances to gluten, dairy and lactose rise globally, consumers looking for relief from chronic digestive complaints are fuelling the boom in free-from products. There is also a growing perception of gluten, lactose and dairy-free products as healthier, more natural and easier to digest, expanding the consumer base beyond those who are intolerant and allergic to the masses with further growth expected over the coming years.

New product developments have accelerated growth in the free-from category, with more manufacturers entering the space offering innovative and appealing products to attract consumers. New ingredients have also entered the scene, and ancient grains is one of the most popular. From quinoa to amaranth, buckwheat or spelt, they are highly nutritious and versatile and can be integrated into gluten-free cereal-based foods or dairy-free alternatives.

Probiotics win in dairy-free alternatives

Probiotics have dominated the digestive health scene for many years. They were inextricably linked to healthy bowel movements and even immune support in consumers’ minds. However, the publicized difficulties in attaining authorized health claims, most notably in the EU, have hindered growth of probiotic yogurt over the last few years, with no signs of recovery ahead.

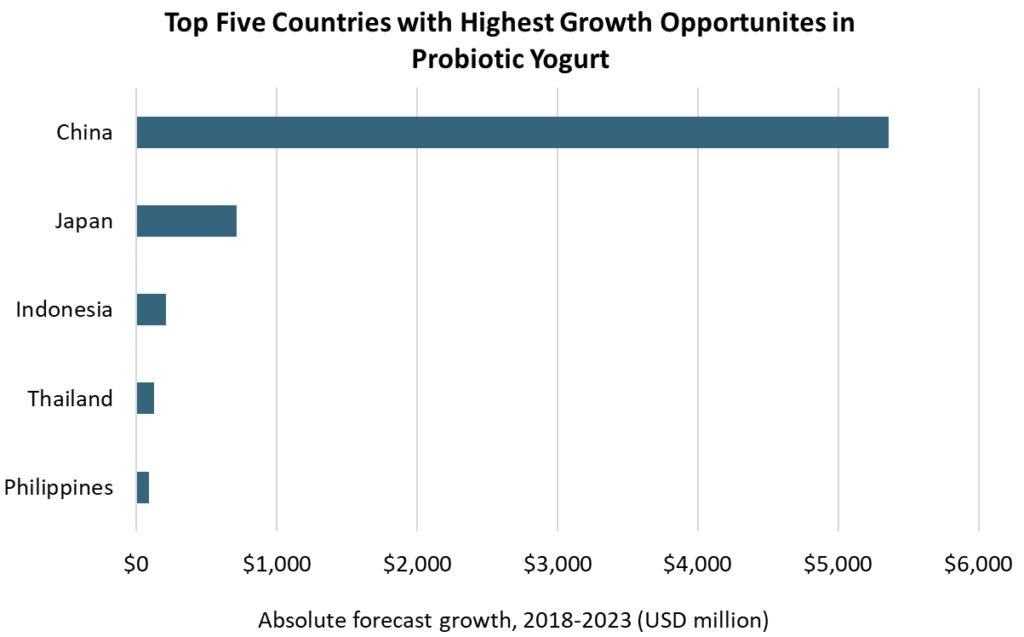

Although probiotic yogurt is losing traction in the Western world, there is still a massive opportunity in several emerging markets. China will see the most robust absolute growth in probiotic yogurt over the coming years, estimated to gain USD3.5 billion in retail sales by 2023, according to Euromonitor. With increasing health awareness of digestion and constant marketing of probiotic benefits by yogurt manufacturers, yogurt is considered a healthy product beneficial to both appetite and digestive health by Chinese consumers. In addition, eating yogurt every day has become a habit for many since it is portable and easy to consume, making it an ideal breakfast or snack.

Source: Euromonitor International

In developed markets, trends are evolving, and opportunities remain plenty in high-growth, but smaller, categories other than yogurt. Kefir is gaining traction in Western markets due to its naturally high-probiotic content and its benefits for gut health, in line with the increasing desire for fermented foods.

Is fiber the new protein?

Fiber has always been associated with digestive health in consumers’ minds. Fiber-rich foods, such as whole grains and fruit, have long counted as traditional household remedies against constipation. However, during the last decade, consumers have been seeking protein as the ultimate nutrient instead of fiber. Although protein is still in the spotlight with no signs of slowing, a new trend toward “high fiber” is rising in parallel. While Western consumers are eating far too much protein in their diet, they are not covering the recommended nutritional intake of fiber, which means that fiber-rich foods would be far more beneficial than high-protein ones.

With more consumer awareness of the much-needed increase in fiber intake, there is huge potential for fiber-rich foods to further develop moving forward.

For further insights, watch our on-demand webinar “Opportunities in Gut Health: Dairy and Beyond”.