With less than 100 days to go until the official Brexit date of 29th March 2019, this is a crucial week for the United Kingdom (UK) in the Brexit process as the meaningful vote on Theresa May’s deal finally takes place on Tuesday 15th January. The vote itself will likely be a formality as all indications point to a large-scale rejection of the deal. What happens next does not have the same degree of inevitability as although there are lots of options on the table, there is no single alternative with a clear majority backing in parliament. Prime Minister May will have three days to present a Plan B once her deal is defeated. Euromonitor International’s current baseline scenario for the UK expects a delayed Free Trade Agreement (FTA) to be reached in 2020.

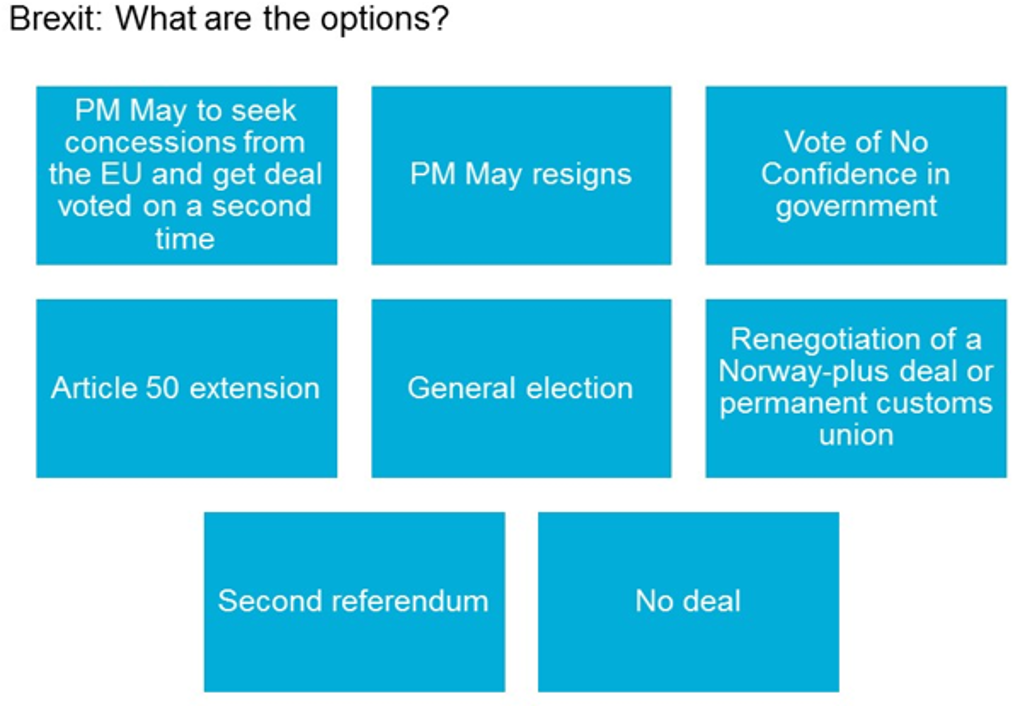

Several options require an extension of Article 50

It is likely that Article 50 will need to be extended to allow time for other options to play out resulting in a delayed Brexit:

- Theresa May could attempt to seek further concessions from the European Union (EU) (once it is clear that there is no backing for it in its current form) and put a revised deal to the House of Commons for a second vote;

- However, there will be calls for the Prime Minister to resign if her deal is rejected;

- Labour has stated that it will table a Vote of No Confidence in the government, which could trigger a general election or a new government;

- Alternatives to Theresa May’s deal include a renegotiation with the EU of a Norway-plus deal or a permanent customs union (backed by Labour) which would be taking the UK towards a Light Brexit;

- Hard Brexiteers would be opposed to this and argue for a managed No-Deal to deliver the results of the 2016 referendum and enable the UK to strike its own deals after leaving;

- If the divisions within the government continue, the consensus would grow to give the vote back to the people in a second referendum, an option which has already been gaining traction in the last quarter. This could also result in a No Brexit scenario.

Euromonitor International’s No-Deal Scenario includes a range of impacts

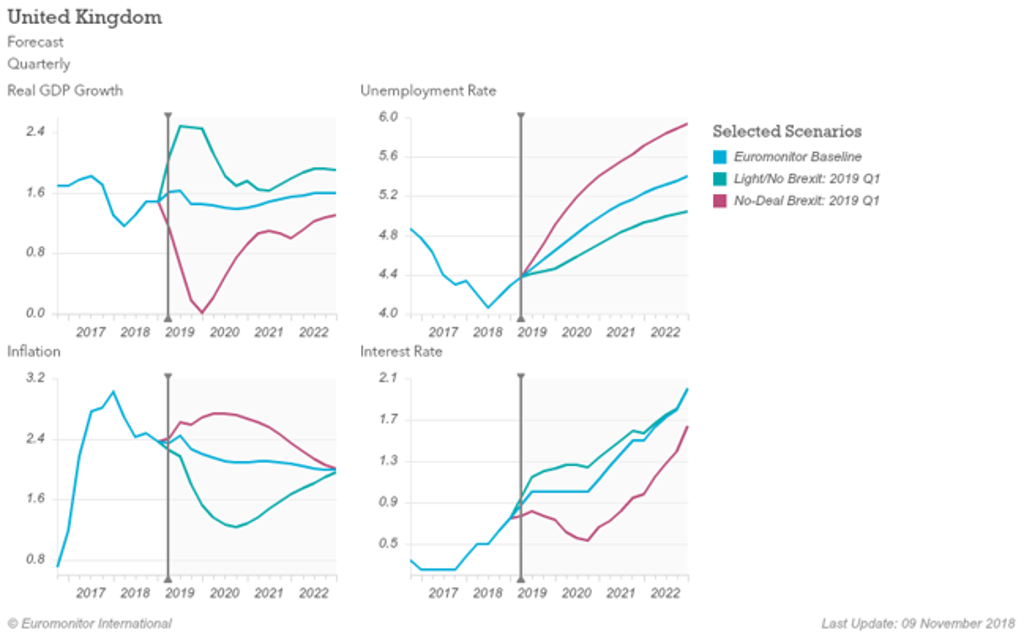

Euromonitor International’s Macro Model highlights that a No-Deal scenario would have the most negative impact on the UK economy, resulting in a sharp slowdown in real GDP growth to 0.5% in 2019 compared to a more positive Light/No Brexit impact where real GDP would increase to 2.4%. A No-Deal scenario would also result in inflation rising to 2.7% by 2020, which will weigh on consumer spending and business investment.

There is an unusually high level of uncertainty on the impact of the logistical bottlenecks and chaos surrounding a sudden exit of the UK from the EU, without a transition period. Conditional on exiting with No-Deal, UK real GDP growth forecasts range from -1.5% to 1.5% in 2019, and from -0.5% to 1.5% in 2020 (with the highest likelihood forecast at around 0.5% annual real GDP growth in 2019-2020).

Source: Euromonitor Macro-Model

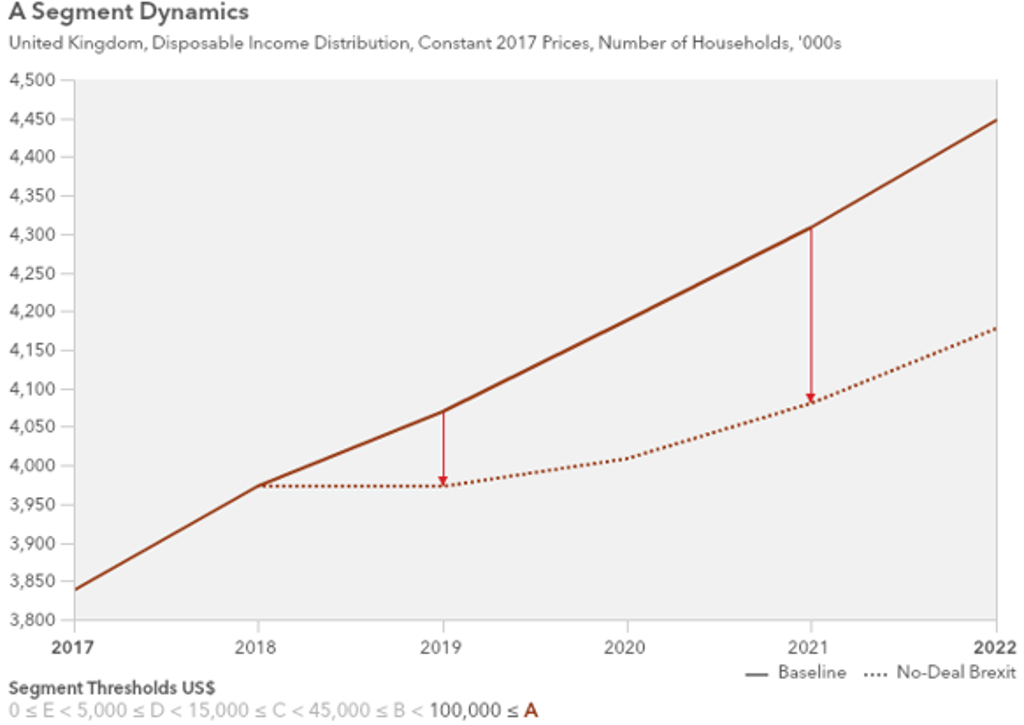

A No-Deal Brexit would also result in movement down the UK’s income pyramid with fewer households in the richest Social Classes A and B by 2022, compared to our baseline delayed Free Trade Agreement (FTA) scenario, and more households moving down to the middle and lower social classes of C, D and E. For example, there will be 269,100 fewer Social Class A households in 2022 in a No-Deal versus Euromonitor’s baseline scenario.

Source: Euromonitor International Consumer Spending by Income Bands Model

Euromonitor International’s Brexit Scenarios Tool helps clients to understand the impact of different Brexit scenarios on our baseline forecasts for the UK economy, industries and consumers. It offers a range of outcomes, providing the tools to stress-test strategy, plan ahead and remain profitable in these challenging times.