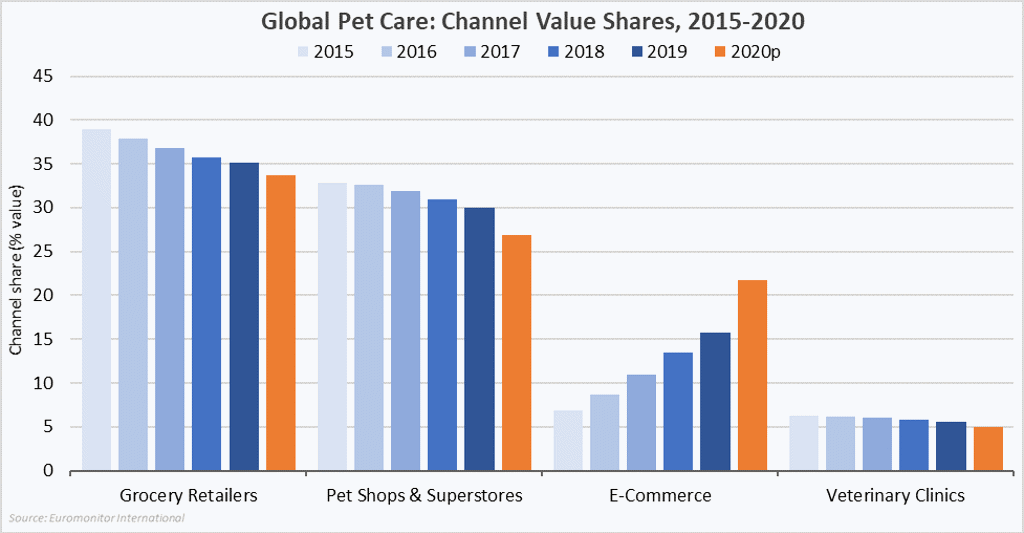

Coronavirus (COVID-19) has rapidly accelerated pet care’s ongoing shift to e-commerce. As shoppers socially distance and prioritise essential trips, e-commerce gains another advantage over store-based retailers.

Pet specialists have also lost many in-store services that helped them maintain traffic. Grooming, boarding, or veterinary services have witnessed steep declines as owners chose to stay home. Some were required to close these services to meet regulations. As a result, the unprecedented share gains that Euromonitor International projects for e-commerce in 2020 will come largely at the expense of pet specialists.

New business models emerge in e-commerce

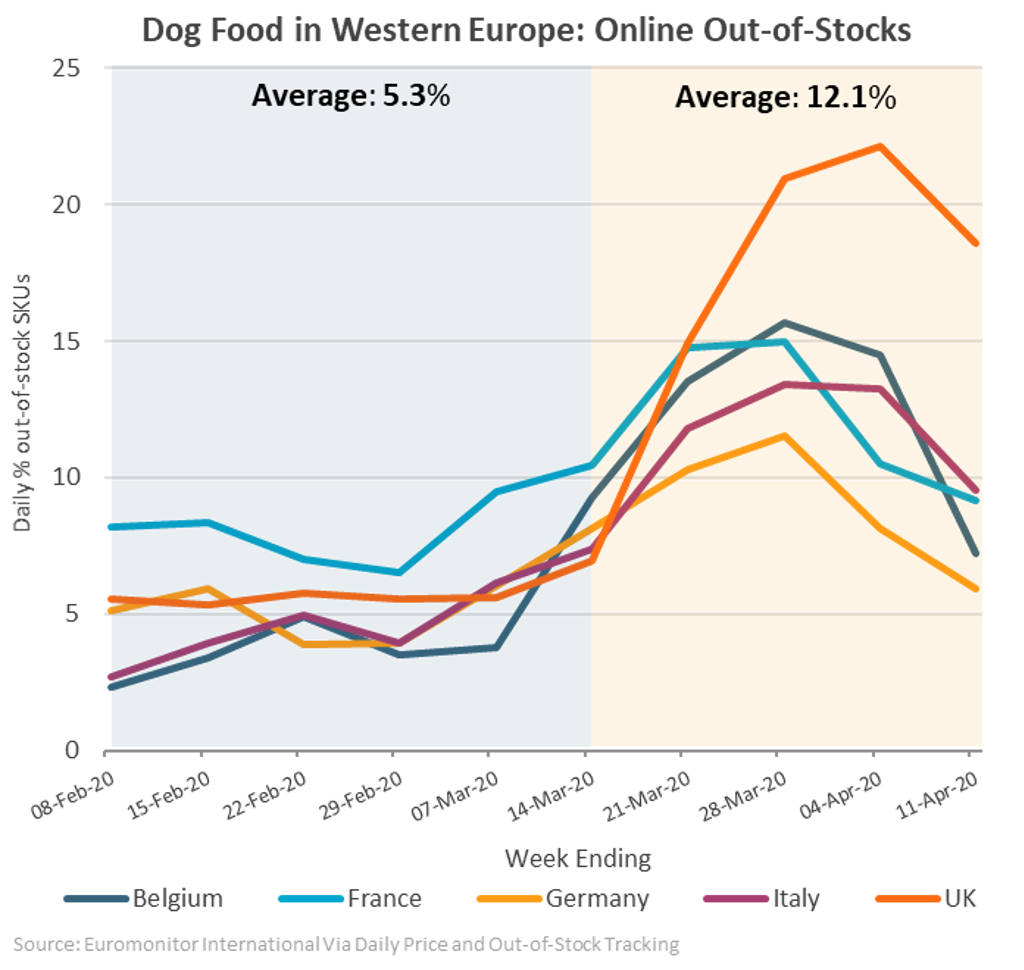

Online retailers that ship to customers (“home-ship”) – like Zooplus, Chewy, Alibaba and Amazon – have driven pet care’s historic online growth. As online demand surged in March and April 2020, however, many of these retailers faced delivery delays or out-of-stock SKUs. Deliveries from Zooplus and Chewy were delayed a week (or more), while Via – Euromonitor’s daily online-tracking tool – saw pet food out-of-stocks surge in regions like Western Europe.

As a result, omnichannel fulfillment models are gaining share. Demand for click-and-collect at grocers like Walmart, Kroger, Tesco, Carrefour, and Target have exploded, whilst many pet stores have created new online pick-up services. Grocery delivery by third-party couriers like Instacart, Glovo and Rappi is growing by triple digits. Uber entered this space in July with a grocery delivery service (via a partnership with Cornershop). In this way, the pandemic is diversifying the e-commerce landscape.

Automation is also becoming increasingly important in online pet retail. Chewy reported that Autoship customers comprised 68% of first-quarter sales in 2020, up 80 basis points from first-quarter 2019. Zooplus reported that SaverPlan customers – which spend 40% more with Zooplus after subscribing – accounted for 45% of first-quarter sales. This indicates that first-time online shoppers under COVID-19 are likely to remain online in the future.

Implications for the competitive landscape

Beyond channel dynamics, these new online models and shifts in the retail landscape have important implications for pet care manufacturers as well.

Premium brands have typically over-indexed with home-ship retailers. Higher margins at pet specialists – the primary competing channel for premium food – have created an opportunity for home-ship retailers. As such, premium brands have a much higher online share than economy offerings.

Omnichannel fulfillment can change this dynamic. When stores serve as local fulfillment centres for click-and-collect or third-party delivery, shoppers are limited to brands stocked at that store. Relative to the “infinite online shelf” of pureplay retailers, omnichannel models feature limited inventories with many economy or mid-priced brands. As omnichannel models reach a new group of shoppers, therefore, economy brands can expand online and widen the competitive landscape in e-commerce.

Automated models also change the competitive landscape by “locking” a consumer in. Shoppers that automate an online order essentially remove themselves from the market. They no longer browse, discover new products, or make unplanned purchases. There is a significant “stickiness” to these models that discourages product changes.

The evolving in-store experience

COVID-19 is also reshaping the in-store experience at pet specialists. As trips become more purpose-driven, there is an emphasis on speed and efficiency.

This is important for impulse-driven categories. Pet treats and accessories, for instance, are “discovery categories” at pet stores. Shoppers visiting a store for food or healthcare supplies often make unplanned purchases of non-essentials. As trips become more focused, however, there is less time for browsing in these categories.

Pet stores have also played important social roles. Shopping alongside a pet provides a bonding experience, and pet owners often socialise with one another. In Brazil, for instance, Petz superstores are a social destination for owners and their companions. These dynamics change in a world of social distancing and purpose-driven trips.

The way forward

Pet care brands need to adapt to these new realities in pet retail:

• Digital is paramount: Brands need to be all-in on e-commerce. It is no longer optional. The online shift from COVID-19 is likely to be permanent.

• Beyond premium: Omnichannel fulfillment is a game-changer for lower-priced brands, which need to invest in digital capabilities as shopping habits change at grocery retailers.

• Target new pet owners: Automation places a premium on new owners. As shoppers lock into automated models, the first purchase becomes crucial. Breeders and vets influence brand selection for new owners.

• Role of in-store marketing: Endcaps, displays and other in-store merchandising will become less useful as traffic dwindles and people make shorter, purpose-driven visits.

• Avenues for impulse: As automation and purpose-driven trips limit browsing and product discovery, brands need to replicate unplanned purchase occasions online.

• Engaging pet owners: As stores evolve as social hubs, brands need to develop new engagement tools. In China, for instance, live streaming has quickly become a popular social platform for pet owners.

For more insight on how COVID-19 is impacting pet care, listen to our webinar Pet Industry Insights in Light of COVID-19.