This article is part of a series on COVID-19 focusing on how the outbreak is affecting industries. Please note the selected goods data used is through 23 February 2020.

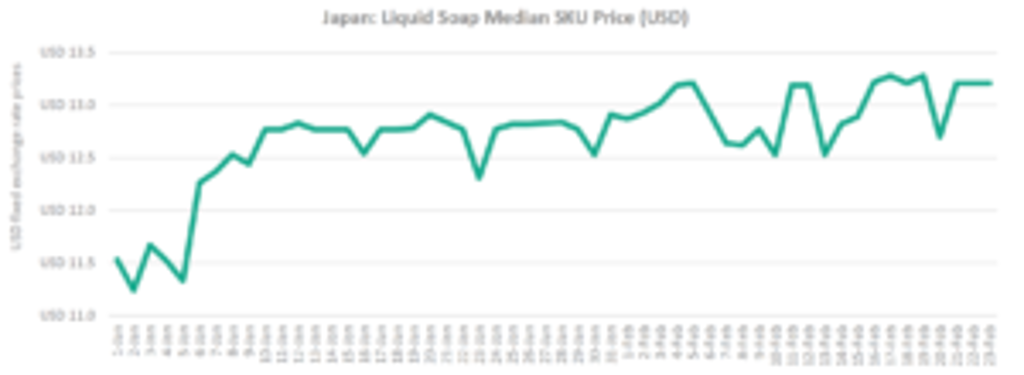

Similar to other countries, COVID-19 is having a dramatic impact on many products in Japan, and one in particular is liquid soap. In Japan, the median price has risen dramatically since the beginning of the year. Tracking over 2,735 liquid soap products on Euromonitor International’s global e-commerce product and pricing monitoring platform, Via, the price of the product started at USD11.53 at the beginning of the year and ended at USD13.21 on 23 February.

Source: Euromonitor Via (1 January-23 February 2020)

That is an increase of 14.6% in just a 54-day time period as consumers stocked up on the product following recommendations from government officials that the best way to combat infection and stop the spread of the virus is through proper hygiene and vigilant hand washing. Median prices for liquid soap showed a sharp increase in the beginning part of the year as news of the virus spread and also as the Japanese media kept a careful watch on the Diamond Princess cruise ship that was docked outside Japan’s Yokohama harbour. As a result, general awareness of the disease was widespread early on and consumers looked to properly prepare themselves. Median prices for liquid soap began to flatten out around the middle of January, but since then have seen notable price fluctuations due to increased demand as worries over COVID-19 have grown.

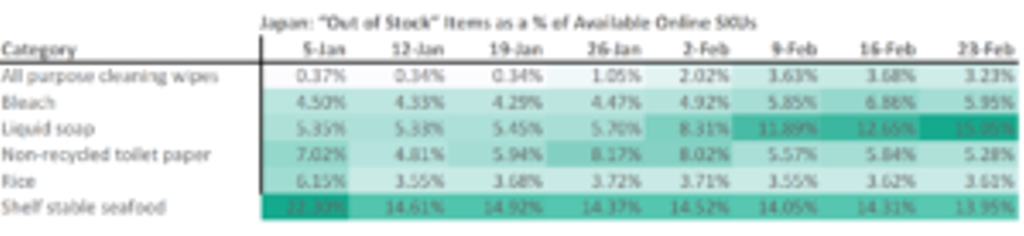

Availability of items due to initial outbreak of COVID-19

With more people staying home from work as companies embrace “teleworking” in Japan and consumers stock up on various goods related to COVID-19 preparation and prevention, Japan’s logistical network has been stretched. While the numbers below do not reflect the situation after Prime Minister Shinzo Abe requested that schools close on 27 February, they do show the impact leading up to the dramatic announcement. With the exception of shelf stable seafood, which is likely due to low stock following the Oshogatsu or New Year’s holiday, several of the selected categories have shown an increase in the percentage of goods sold online becoming out of stock since the beginning of the year.

Source: Euromonitor Via (5 January-23 February 2020)

As previously discussed, liquid soap’s dramatic median price increase is the result of increased demand, with the category’s out of stock percentage nearly tripling in the 7-week period, starting at 5.35% on 5 January and reaching 15.05% of goods being listed as out of stock on 23 February.

There has also been a lot of news surrounding the availability of paper-related products, with consumer concerns mounting following a rumour that all tissue-related production was moving towards face mask production. However, tissue and paper companies alleviated these fears by showcasing pictures of warehouses filled with toilet paper and other tissue products, and stated that logistical bottlenecks were the reason for low stocks versus lack of supply. As a result, the out of stock percentages for non-recycled toilet paper display a bell-shaped trend of a rush to buy products (“panic buying”) leading to a peak of unavailable items on 26 January and 2 February and then falling back to previous levels thanks to Japan’s logistical capabilities catching up with demand or consumers working through their stockpiles.

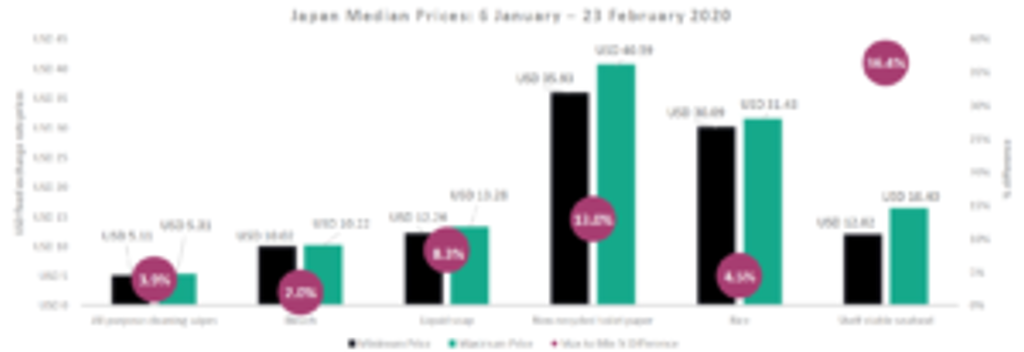

Pricing dynamics in Japan

Besides liquid soap, several other products showed price fluctuations during the onset of the COVID-19 outbreak in Japan, which can be examined by comparing the minimum median price to the maximum median price over the time period from 6 January to 23 February 2020. Analysing the prices from 6 January (the first working day after the New Year’s break), shelf stable seafood and non-recycled toilet paper showed the largest differentials due to increased demand from consumers preparing to deal with the situation as well as difficulties finding available items.

That being said, Japan is well known for its price-conscious consumers and the difficulties that presents for companies trying to raise prices, so it is no surprise that other product categories that have seen large price increases in other countries showed less than a 10% differential in Japan. There has also been a lot of social media public shaming for companies that have tried to raise prices for goods such as face masks, so Japan’s consumers are keeping a vigilant watch on prices for categories related to COVID-19 more generally.

Source: Euromonitor Via (6 January-23 February 2020)

Next steps for Japan

Japan’s government is urging its population to remain calm, and companies have been showcasing their logistical strength and distribution networks to ensure that products reach consumers in a timely manner and that those that do sell out are quickly replaced. However, as more companies begin implementing “telecommuting” policies and urging people to stay away from large crowds, consumer behaviour will change, and the pricing dynamics of products will likely fluctuate. Looking ahead, companies will need to continue to transparently communicate availability of goods to prevent or at least minimise additional “panic buying” and the potential impact that this will have on e-commerce product prices and availability.