This article is part of a series on COVID-19 focusing on how the outbreak is affecting industries, economies and consumers. Please note that these scenarios were last updated on 27 April 2020.

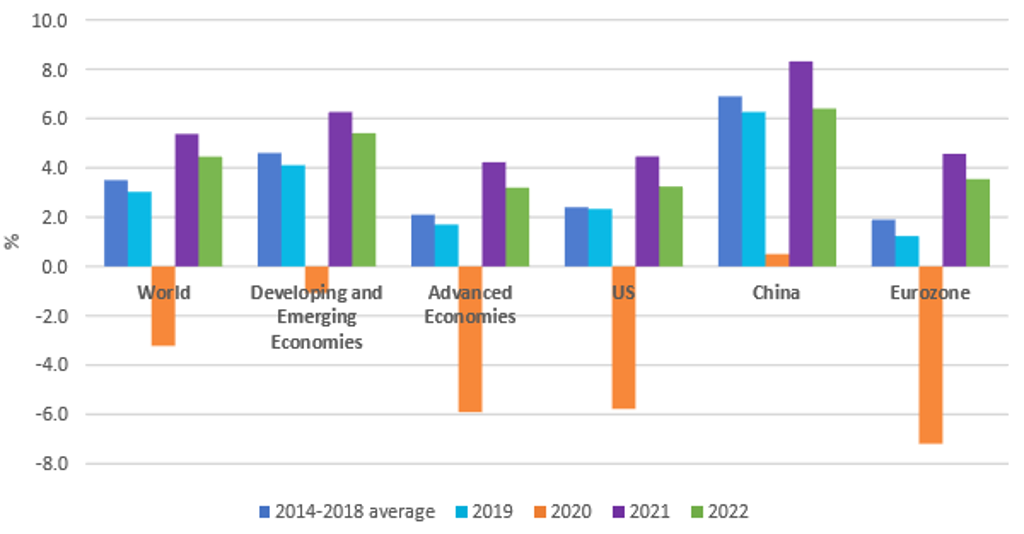

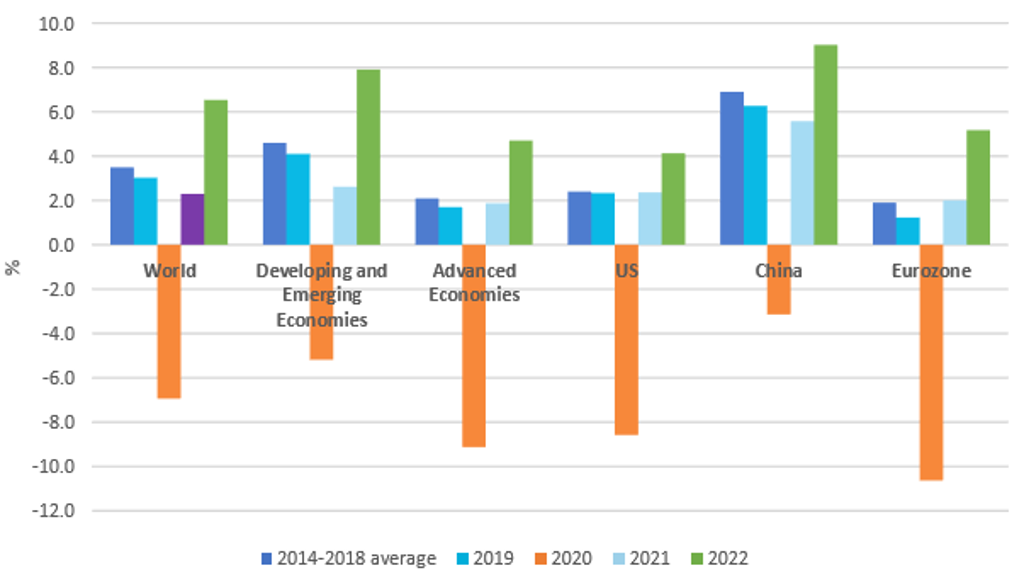

The expansion of the Coronavirus (COVID-19) outbreak into a global pandemic in March 2020 has shifted the global economic outlook, with the 2020 recession expected to be the worst since the Great Depression. At the end of April, Euromonitor International further downgraded the baseline global real GDP growth forecast for 2020 to a range of -4.0% to -1.5%, compared to 2.6-3.4% growth forecast in the last pre-COVID-19 pandemic forecast:

• Advanced economies are expected to be the hardest hit in this recession, with their economic activity contracting by around 6% in 2020. This reflects the strong spread of the pandemic in these economies, and the willingness of these countries to engage in costly social distancing measures to reduce infection and death rates;

• Emerging and developing economies are also likely to be badly hit, with output contracting by around 1% in 2020 due to both social distancing measures and stronger financial and trade spillover effects.

Global Real GDP Growth Baseline Forecast: 2014-2022

Source: Euromonitor International Macro Model, National Statistics. Note: Global real GDP growth using PPP weights; figures for 2020 onwards are forecasts; forecasts updated on 27 April 2020

A partial recovery to pre-crisis economic activity trends is expected in 2021-2022, with global output growth of 3.5-7.0% in 2021. However, these baseline forecasts are subject to an extreme level of uncertainty tilted to the downside, with the baseline forecast assigned a 38-48% probability over the next 12 months.

The baseline forecast reflects the combined adverse effects of COVID-19 social distancing restrictions, supply disruptions, significant tightening of financial conditions, a spike in private sector uncertainty, falling household disposable incomes and sharp drops in global trade and commodity prices.

Social distancing restrictions have led to large declines in business revenues, employment and wages, with each month of strict quarantine/lockdown estimated to cause a 25-45% decline in economic activity relative to normal. The baseline forecasts assume that the strict social distancing measures successfully contain the pandemic. This would allow for a gradual relaxation of the quarantine/lockdown restrictions imposed in many countries in H2 2020.

Real GDP Growth Baseline Forecasts in Key Economies: 2019-2027

Source: Euromonitor International Macro Model, National Statistics. Note: Global real GDP growth using PPP weights; revisions are relative to pre-pandemic January 2020 forecast; figures for 2020 onwards are forecasts; forecasts updated on 27 April 2020. Yellow depicts a negative revision and blue a positive revision

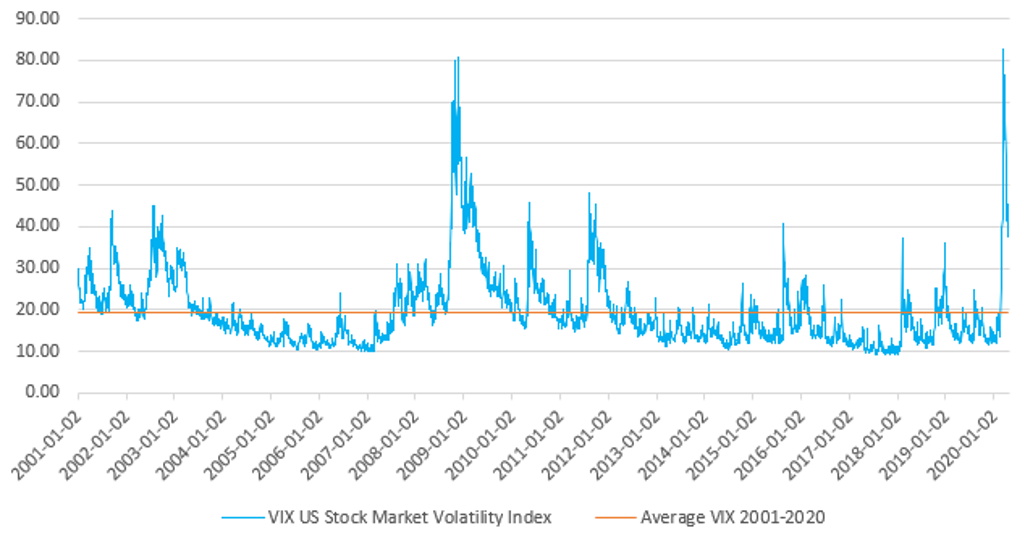

Worsening financial conditions amplify the pandemic’s economic damage

Financial market uncertainty has increased to a level comparable to that during the 2008 Global Financial Crisis (using the VIX stock market volatility index), and risk premia have jumped since the beginning of the year. Global stock prices have rebounded from the roughly 30% crash in March, but they are still around 15% below their levels at the beginning of the year, and they remain highly volatile.

US Stock Market Volatility Has Reached Levels Comparable to 2008 Global Financial Crisis

Source: Euromonitor International from Federal Reserve Economic Data

Business shutdowns have led to massive cuts in working hours. This has caused large drops in disposable income, especially for young workers in the services sector with low cash reserves. Governments in advanced economies have reacted to the losses of business and household incomes with unprecedented fiscal and credit stimulus measures, with government spending increases of 10-20% pre-pandemic output.

The baseline outlook assumes these measures in advanced economies are enough to avoid massive business liquidations, eliminate most of the losses in disposable income for workers and stabilise financial conditions. Governments in emerging and developing economies have much more limited space for fiscal spending stimulus. As a result, developing economies are likely to see stronger financial amplification of the effects of negative shocks from social distancing and falling export revenues on private-sector spending.

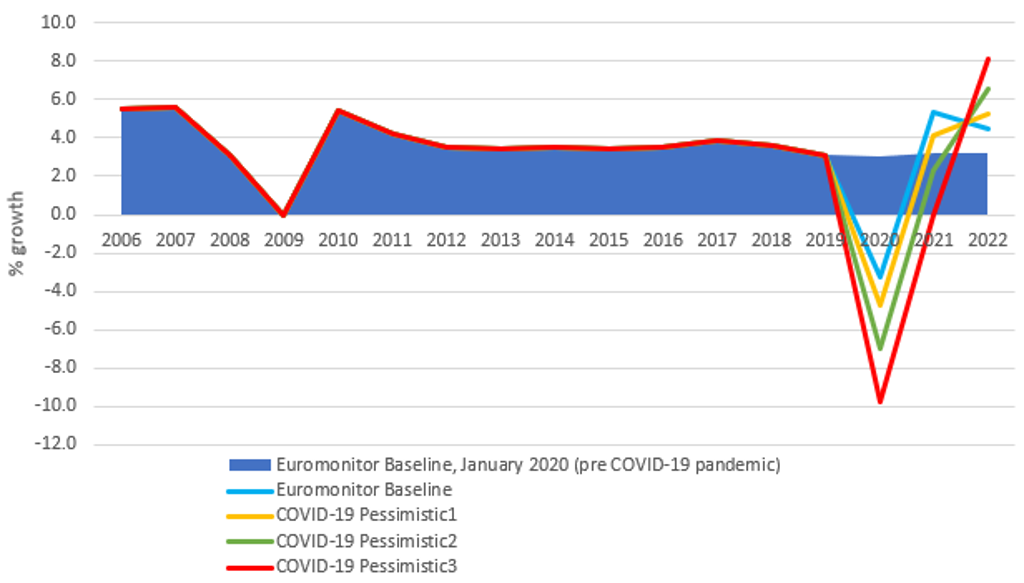

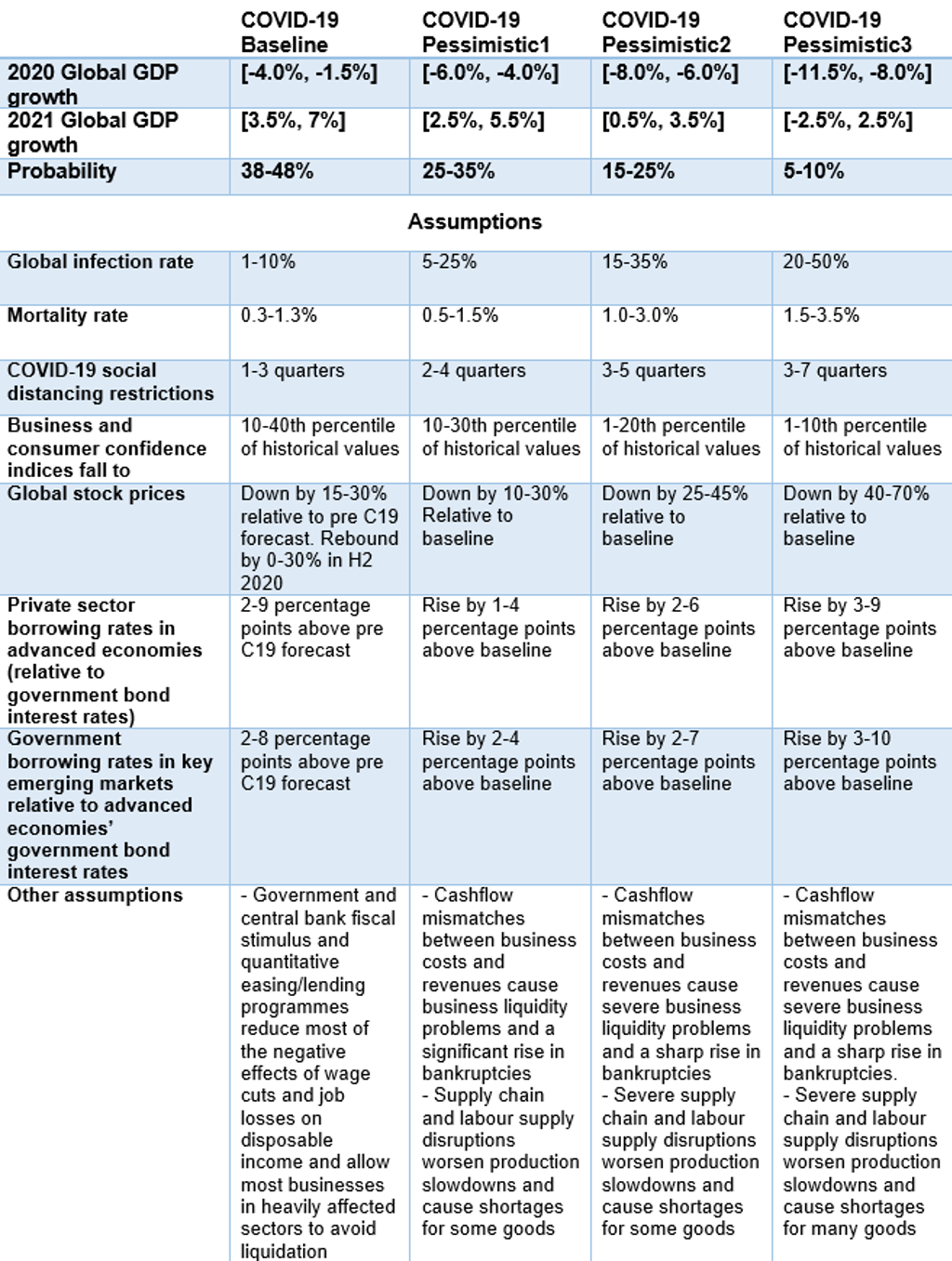

Alternative pessimistic COVID-19 scenarios are as important as the baseline forecast

The COVID-19 recession is projected to be significantly deeper than the 2008 Global Financial Crisis over the short term, although the recovery is expected to be faster. However, the baseline forecast is subject to large downside risks. There is substantial uncertainty about the effectiveness and length of COVID-19-related social distancing restrictions, the path of the pandemic, financial stability and the ability of governments to contain the negative effects of lower disposable income and higher uncertainty on private-sector spending.

Global Real GDP Growth, Baseline and Alternative Scenarios: 2006-2022

Source: Euromonitor International Macro Model, National Statistics. Note: Global real GDP growth using PPP weights; figures for 2020 onwards are forecasts; forecasts updated on 27 April 2020

To account for all this uncertainty, we assign a 38-48% probability to our baseline forecast. The remaining probabilities are assigned to three COVID-19 pessimistic scenarios. These scenarios differ in assumptions regarding the severity of the pandemic, the extent of social distancing restrictions and the severity of the effects on financial conditions. In the worst scenarios, the COVID-19 recession is transformed into a joint pandemic and financial crisis, with the recession potentially continuing in 2021 and significant long-term declines in output relative to pre-recession forecasts.

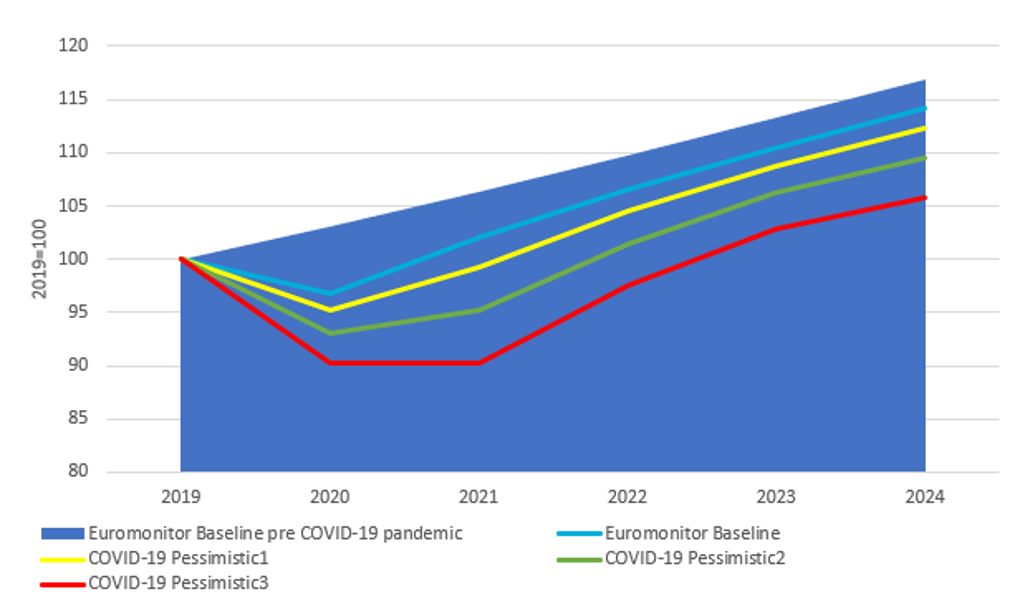

Global Real GDP Index, Baseline and Alternative Scenarios: 2019-2024

Source: Euromonitor International Macro Model, National Statistics. Note: Global real GDP growth using PPP weights; 2019 world real GDP = 100; figures for 2020 onwards are forecasts; forecasts updated on 27 April 2020

The main downside risk (accounting for both probability and economic impact) is the COVID-19 Pessimistic2 scenario. In this scenario, the COVID-19 pandemic is deadlier and harder to control than expected, causing significant social distancing restrictions to extend into the second half of 2020 or early 2021. This causes more substantial supply disruptions, liquidity problems for businesses and households, and a more severe decline in private sector confidence. Financial market conditions also tighten considerably more than in the baseline forecast. As a result, global economic activity contracts by 6% to 8% in 2020. The recovery is much weaker than in the baseline forecast, with global real GDP growth of 0.5% to 3.5% in 2021. We assign this more pessimistic scenario a 15-25% probability.

Global Real GDP Growth in COVID-19 Pessimistic2 Scenario: 2014-2022

Source: Euromonitor International Macro Model, National Statistics. Note: Global real GDP growth using PPP weights; 2019 world real GDP growth = 100; figures for 2020 onwards are forecasts; forecasts updated on 27 April 2020

Recently, there have been signs that the growth of the pandemic may be stabilising. There has also been a relaxation of some social distancing measures in countries such as Germany. However, significant social distancing measures are likely to remain in place in major economies for the rest of Q2 and Q3, and the pandemic may still be worsening, especially in emerging and developing economies. There are also ongoing concerns about a renewed increase in the case growth rate as economies try to roll back social distancing measures, and the risk of a second wave of infections emerging. The baseline outlook remains a deep global recession with high downside risks.

COVID-19 Scenario Probabilities and Assumptions