Coronavirus (COVID-19) is expediting some of the key trends that have developed during the last few years in the food industry. One of these is plant-based eating, which has gained momentum during the pandemic, driven by health concerns and disruptions in the meat supply chain. Closing the pricing gap with animal-based counterparts will remain a key challenge but price sensitivity can be reduced by perceived added value.

Health takes precedence for consumers

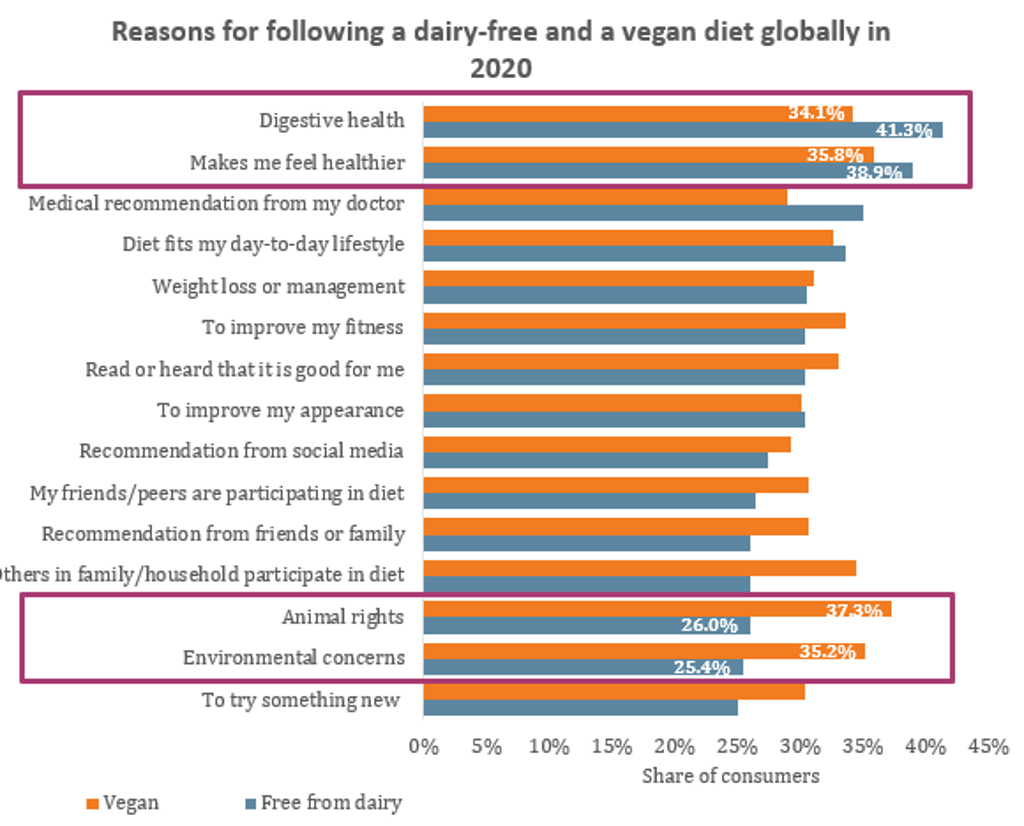

Ethical reasons are highly compelling drivers of the plant-based boom and the adoption of flexitarian and vegan diets. However, health remains the key motivator for dairy-free diets. For consumers adopting vegan diets, health closely follows animal rights as the main drivers.

Consumers are rushing to buy food and drinks that can provide certain functionality or that they perceive as healthy. The power of plants in supporting health and their content of valuable nutrients are well recognised. However, plant-based dairy and meat analogues are generally heavily processed. Lack of consumer awareness that they are very processed and direct association of plant-based ingredients with “better for you” options have helped to accelerate the trend in times when health has taken precedence.

News around the potential ability of pathogens to infect humans from an animal host (zoonotic diseases) has also put animal-sourced food in the spotlight for many who are deliberately avoiding these foods.

Source: Euromonitor International Health and Nutrition Survey, fielded February 2020, n=21,739

Meat shortages benefit plant-based alternatives

Plant-based products have also benefited from the initial panic buying and stockpiling effect observed during lockdowns. This has partly been driven by the shelf-stable nature of some of the milk alternatives and the frozen variants in meat analogues, but most importantly by disruptions in the supply chain. The meat industry faced shortages during the lockdowns in countries such as the US due to virus infections in meat processing plants. This was a huge advantage for meat analogues that attracted first-time plant-based eaters during these times. Consumers who enjoyed the experience may stick to it.

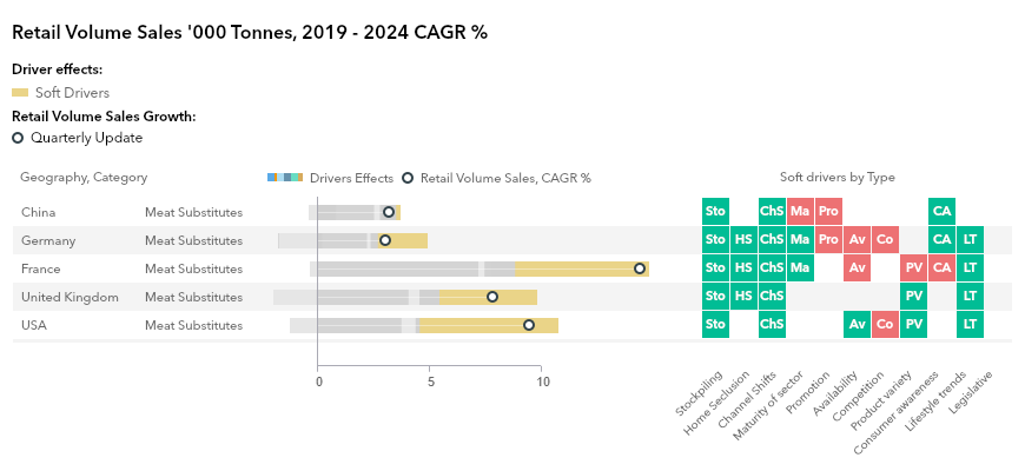

Euromonitor International’s Industry Forecast Model shows that stockpiling is indeed one of the key demand drivers, not only in the US but also in the UK and France among others.

Source: Euromonitor International’s Industry Forecast Model. CAGR: Compound annual growth rate. The chart represents the total percentage of volume growth for meat substitutes in selected markets. This is decomposed into positive and negative percentage points effects for individual demand drivers. In this chart, Soft Drivers are highlighted. Soft Drivers are based on empirical research and local market observations and includes the soft drivers by type indicated on the chart on the right. This can have a positive or negative effect on the growth of a category.

Will high prices slow down the trend?

Consumers are curbing their discretionary spending as a result of the economic recession in 2020. One would assume that plant-based demand would slow down given these alternatives are notably more expensive than their animal-based counterparts. Indeed, there is downward price pressure and the industry has already made strides on this front before COVID-19. This is very apparent in meat analogues, where retailers such as Lidl in Germany offer more competitive prices than the likes of Impossible Burger or Beyond Meat. Demand for private label and affordable brands is expected to rise as disposable incomes fall.

However, price sensitivity can be reduced by perceived added value. The belief that plant-based alternatives are healthier is a key reason for consumers willing to pay an extra. This is very significant in milk alternatives, especially non-soy options. Almonds, oats, coconut and peas have spurred innovation in the category, and these are perceived by many consumers as healthier and better for digestion than cow’s milk.

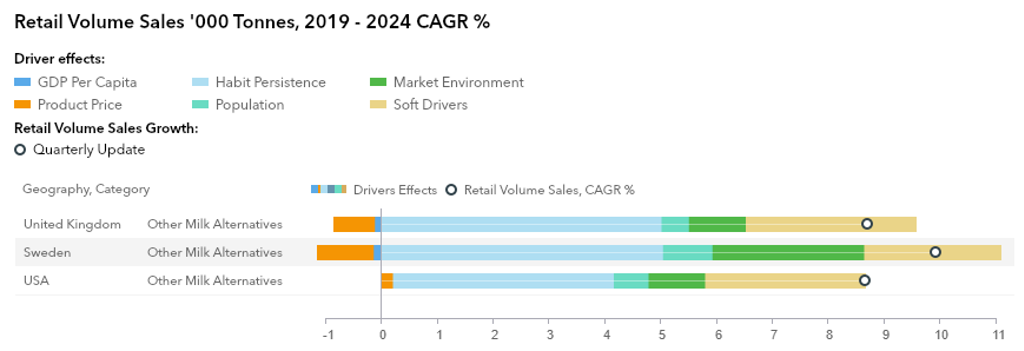

Euromonitor International’s Industry Forecast Model shows that price is no longer a negative driver of volume growth in the US as these options became price competitive against dairy. In other markets such as the UK or Sweden, price remains a negative factor constraining adoption, but positive demand drivers have a stronger influence. Soft drivers include lifestyle trends in which health and the adoption of flexitarian diets play a key role.

Source: Euromonitor International’s Industry Forecast Model. CAGR: Compound annual growth rate. The chart represents the total percentage growth for other milk alternatives (including non-soy variants) in selected markets. This is decomposed into positive and negative percentage points effects for individual demand drivers.

Opportunities in plant-based moving forward

Although health is one of the key motivators of plant-based alternative purchasers, these products are generally heavily processed and contain lengthy ingredients lists. There is a need to bring in clean-label offerings to avoid a consumer backlash in the long run.

Pushing for pricing strategies to increasingly make these offerings competitive with their animal-based counterparts will remain key. Focusing on ingredients that bring added value is essential to reduce price sensitivity, either nutritional benefits or with certain functionality (e.g. pea for a protein boost or addition of omega-3 in dairy alternatives for brain health positioning).