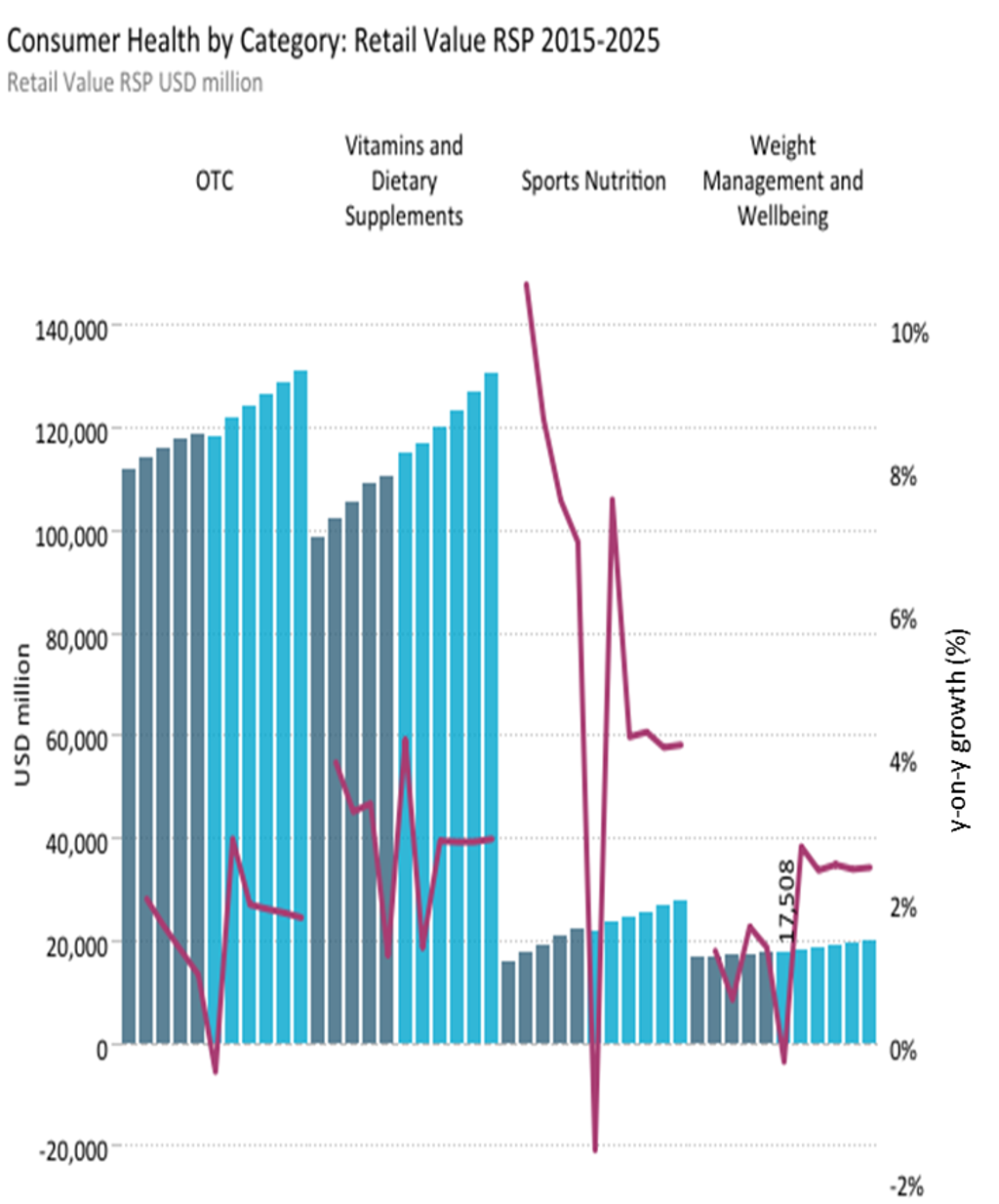

The consumer health industry, valued at USD272.9 billion in 2020, is set to grow by 1.4% between 2019-2020 in constant value terms, slightly lower than growth from the previous year. Along with the effects of maturing markets, there is a continued lack of category enhancing RX (prescription)-to-OTC switches and genuinely innovative products.

In addition to this, Coronavirus (COVID-19) has left the consumer health industry largely reactive, with many categories and ingredients rendered inert in the face of the singular focus that global consumers have, due to the pandemic.

While sales in Western Europe, Latin America and Eastern Europe benefited from stockpiling at the start of 2020, global sales of OTC drugs continue to decline in 2020 due to the sluggish nature of the industry. The top four categories within OTC medicine (cough, cold and allergy remedies, analgesics, digestive remedies and dermatologicals) account for 86% of all OTC sales but have seen negative growth at constant 2020 prices. However, both acetaminophen and sleep aids benefitted positively during 2020, as consumers responded to COVID-19. Between 2020-2025, OTC medicine will benefit from emerging markets where the historic use of such products has been less prominent.

Source: Euromonitor International’s Consumer Health Research, published 7 September 2020. Note: Values in USD, fixed 2020 exchange rates and constant 2020 prices

Sports nutrition and weight management will pick up pace after a decline in 2020

The decline in sports nutrition in 2020 was the result of business closures (mainly gyms and health clubs) at the start of the pandemic, which limited the use of sports nutrition products by its regular consumer base. Additionally, even with economies “returning to business”, consumers remain sceptical about returning to the old forms of exercising for fear of infection. Many have also become comfortable with new home-workouts/cardio routines that do not require sports nutrition products.

Home seclusion in 2020 also means that weight management and wellbeing have seen a decline in sales. The lack of social pressure to reduce weight has had a direct impact on the category. Consumers have tended to opt for eating sit-down meals at home instead of meal replacement products.

However, Euromonitor International expects both categories to bounce back over the forecast period, assuming consumers go back to their regular routines, and social distancing measures become less restrictive.

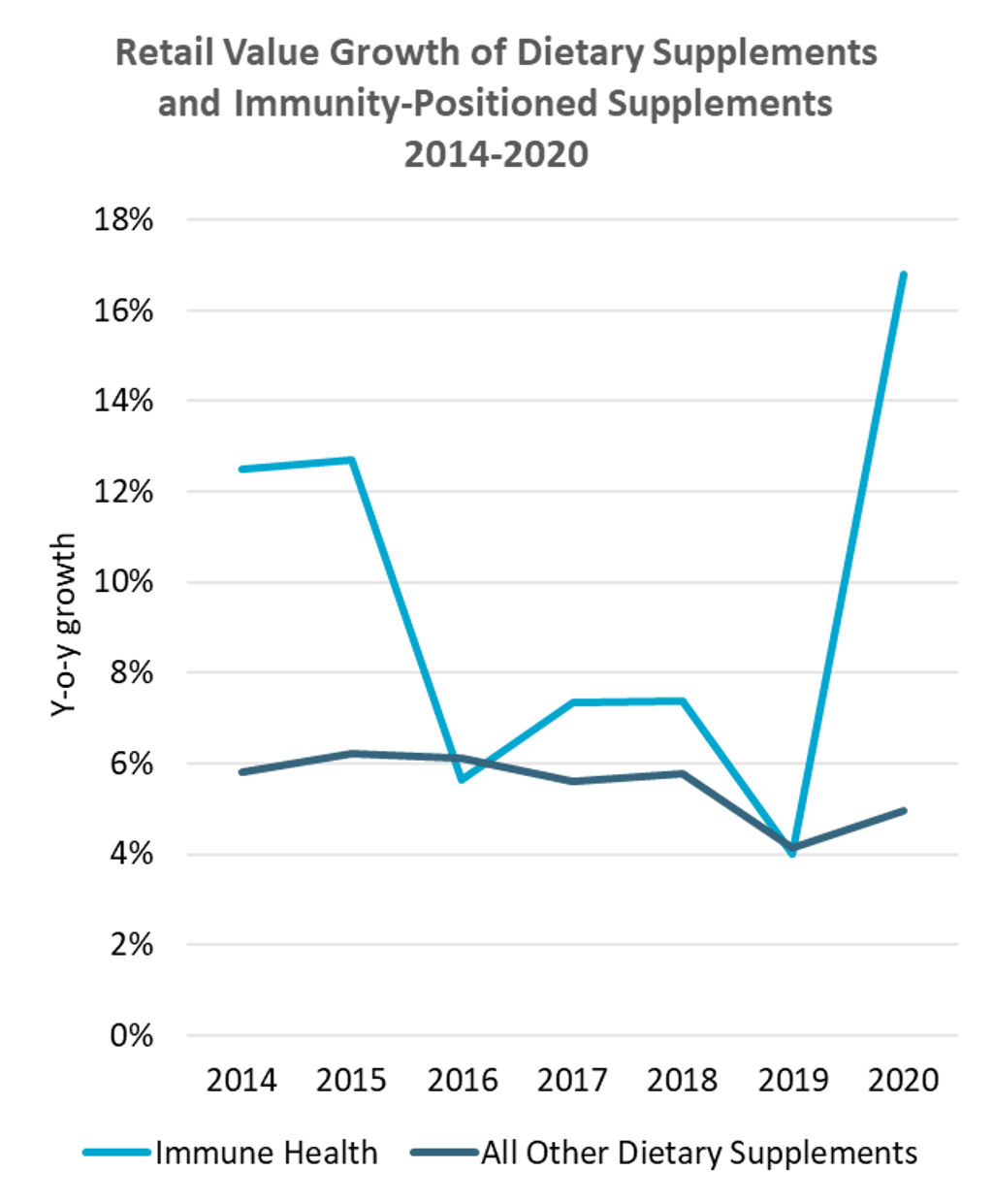

Demand for immunity-positioned dietary supplements propels VDS forward

Since the start of the pandemic, there has been a clear emphasis on preventive health. With the onset of the pandemic, consumers sought out products such as vitamin C, vitamin D and other immunity-based dietary supplements to protect themselves against the unknown virus. This has benefitted sales of vitamins and dietary supplements overall, with Latin America leading growth in immunity-based dietary supplements.

This behaviour is expected to stick, and the future for this category will be driven by consumers seeking immunity, as well as manufacturers positioning new and proven immunity ingredients. Echinacea and elderberry in the US, ginseng and mushrooms in China, turmeric and tulsi in India are some examples of products that could further benefit from this trend.

Source: Euromonitor International’s Consumer Health Research, published 7 September 2020. Note: Values in USD, fixed 2020 exchange rates and constant 2020 prices

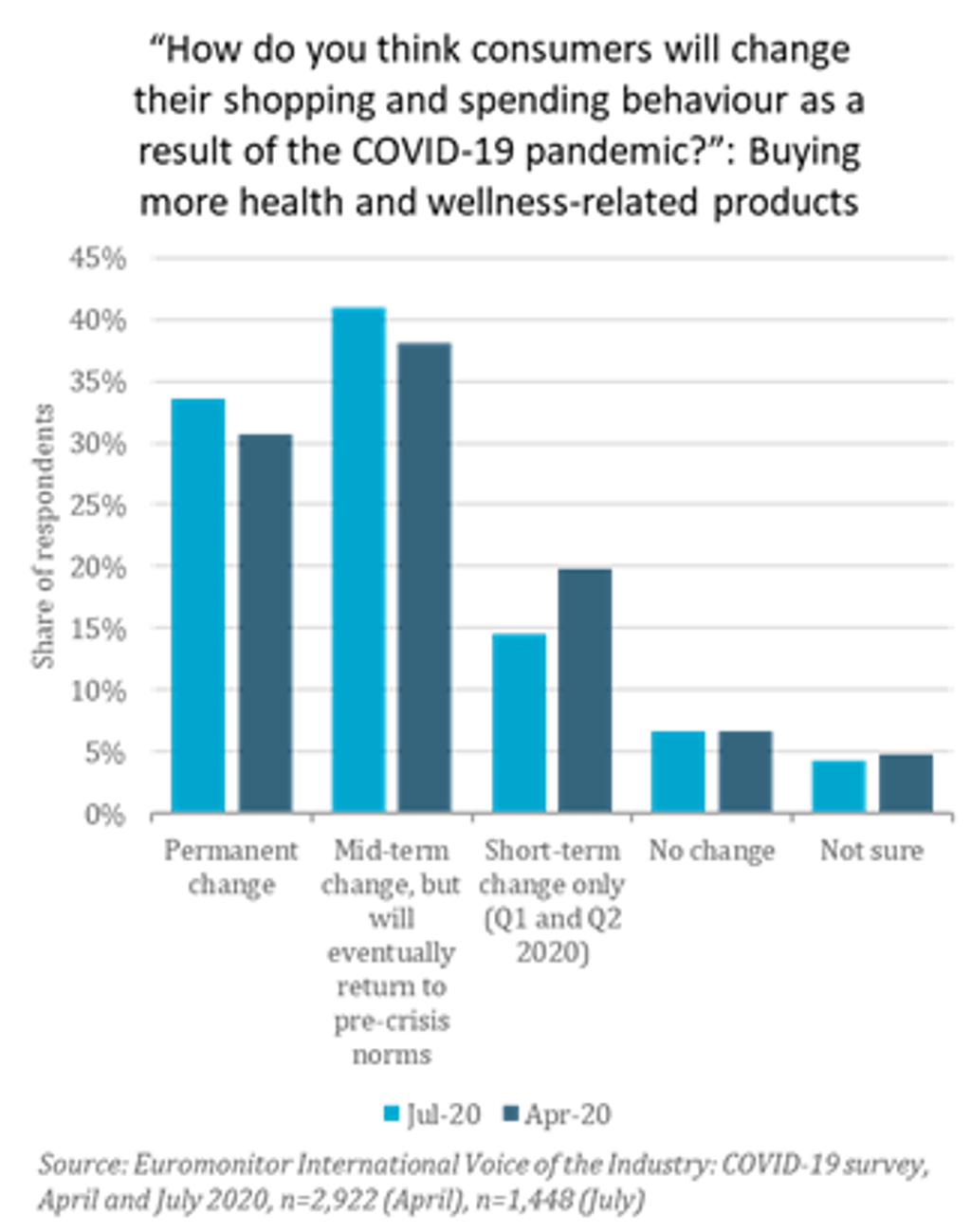

With increasing demand for holistic wellness, manufacturers will benefit from innovating in the immunity space as well as addressing consumers’ wellbeing concerns with a focus on sleep and mental health. According to Euromonitor International’s Voice of the Industry COVID-19 Survey, fielded in July 2020, more than 70% of respondents believe that consumer attitudes towards buying health and wellness related products will have a mid to permanent change.

Source: Euromonitor International’s Voice of the Industry: COVID-19 Survey, April 2020, July 2020

However, longer-term interest in traditionally strong categories will recur, especially in sports nutrition and weight management. Focus areas such as beauty, energy, digestion, stress, cognition will also create new opportunities, irrespective of the category. The shift to e-commerce will slowly but surely be key for the industry, as it looks to limit the longer-term impact of the pandemic.