Barilla Holding SpA is expected to foray into chocolate spreads in 2019, generating huge interest globally. How will its entrance affect consumers and the chocolate spreads market? What impact will it have on Barilla’s position in packaged food? And the big question – will Nutella’s pedestal be shaken?

Tapping on evolving consumer values

The chocolate spreads market has had a clear world number one for years. Ferrero SpA has successfully established and retained its leadership globally with Nutella. In its home market of Italy its dominance seems uncontested with 88% market share, and it does not seem likely that any brand will challenge its position. Yet, its grip over the market has gradually loosened over the years since 2013, as consumer preferences steadily shift towards niche brands. Consumers increasingly favour brands that project a relatable image and resonate with their values, such as using sustainably-sourced and healthier ingredients.

The narrative of ethical living and healthy living has attracted even non-artisanal brands, such as Barilla. The impending launch of its chocolate spread in 2019 cleverly highlights its avoidance of palm oil, use of locally-sourced nuts and lower sugar content and saturated fats. These strengths seem to dig at Nutella’s use of palm oil, and fat and sugar content that have health advocates questioning its suitability for children and place at the breakfast table.

Looking beyond pasta, Europe and the Barilla brand

The Barilla name is already established worldwide, with pasta as its bread and butter, particularly for markets outside of Europe where it has successfully positioned itself as a manufacturer of Italian cuisine.

Expanding its portfolio by investing in the sweeter side of packaged food could prove lucrative for Barilla as it is globally known for its savory portfolio. The primary application of chocolate spreads with bread could cater to the sweet-toothed while maintaining the company’s overall association with staple foods.

The versatility of chocolate spread also represents a huge opportunity for growth. Aside from use as a spread, it could also be an ingredient for drinks and desserts. However, as this diversity is typically spearheaded by Nutella fans, consumers may not necessarily do the same with Barilla’s version of chocolate spread.

In the long term, global launch of a chocolate spread could be baby steps towards building stronger worldwide brand recognition beyond its namesake brand and primary product. This is even more so as Barilla’s chocolate spread is touted to contain cookie crumbs from its Pan di Stelle sweet biscuits. Chocolate spread may well pave the way for the introduction of Barilla’s snack brands into emerging markets and non-European countries, where snacks categories are generally more fragmented and competitive, compared to pasta.

Will there be a new leader?

Barilla might be a strong contender in chocolate spreads and climb the ranks quickly, as the competitive landscape following the top spot is fragmented. Penetration into markets would likely leverage on the established distribution channels and logistics of its dried pasta and pasta sauce products, enabling it to gain share quickly. Likely competitors include household names in chocolate like Hershey and Mondelez and other spreads leaders such as JM Smucker Co.

Within Italy, Barilla is well-positioned to be Nutella’s main competitor in the domestic market given its well-established trust and familiarity with local consumers. The extent of its growth in the market will depend on how successfully consumers can overcome purchasing habits and brand loyalty, to make the switch from Nutella in the name of ethical and health priorities.

[caption id="attachment_56343" align="alignnone" width="640"]

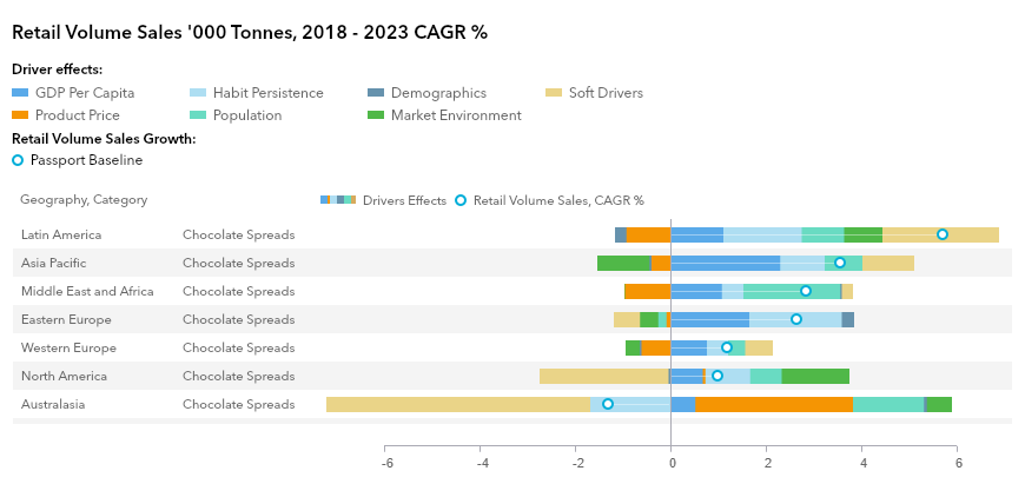

According to Euromonitor International’s Packaged Food Industry Forecast Model, emerging regions like Latin America, Asia Pacific, and Middle East and Africa are expecting an upsurge of retail volume for chocolate spreads up to 2023. A strong driver is the expanding middle class and widening disposable incomes, consumer awareness and strengthening availability of such products. Lifestyle habits such as health and wellness are forecast to have negative repercussions on Australasia and North America. Should Barilla address these concerns effectively, it could stand a chance to win over Nutella adversaries.