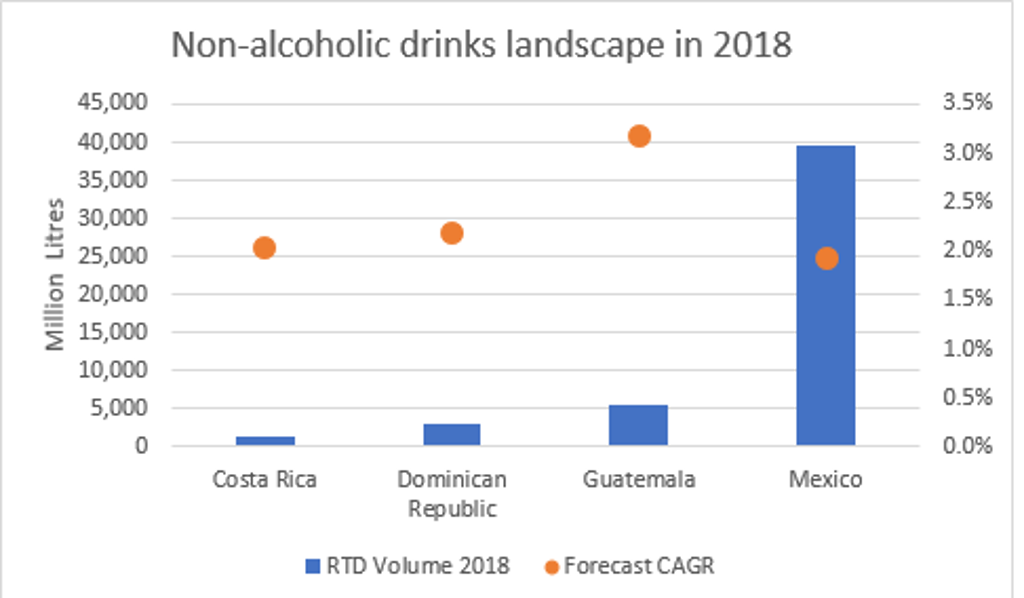

The Central American markets are an emerging focus for soft drink companies around the world. Mexico is the sixth largest market for soft drinks and Latin America is projected to grow at 2.1% CAGR over the next five years, outpacing North America and Western Europe.

Every year, Euromonitor International’s in-country analysts for Mexico, the Dominican Republic, Costa Rica and Guatemala come together to discuss the latest updates on trends defining the beverage industry. These are some regional trends identified during their exchanges.

*All data and figures includes provisional estimates for Mexico, the Dominican Republic, Costa Rica and Guatemala.

Health and wellness sticks to the juice category

The abundance of freshly grown tropical fruits means that juice consumption is heavily tied to culture and tradition. However, there is a growing focus on health and wellness occurring in this region. For example, an established company in the U.S., Jugos Caribe is bringing their signature HPP bottled, premium chilled healthy juices to its home market, the Dominican Republic. In Guatemala and Costa Rica, private label is entering the juice categories and brands like Great Value are adding value by fortifying their products through reformulations or providing organic SKUs in the modern channel.

Coconut and other plant waters are also a sub-category to watch in the coming years. In Mexico, Acapulcoco is revitalizing the category, and over the next five years, Euromonitor International expects the sub-category to grow at 3.9% CAGR compared to its 1.9% growth in 2018.

Concentrates, mature and innovative

Because of its economy positioning, concentrates have been the preferred choice for many Latin American consumers. The market is fairly mature with over 15 years of stable growth for many of the Central American countries. Yet, this category isn’t slowing down. In fact there are some innovations happening on this market, particularly from a break out brands produced by Quala SA, a market player known for their success with their energy drink brand Vive 100. Across the Central American region, JugosYa (Quala) claimed a stake in these markets, capturing attention due to both affordability and exotic flavour offerings, such as horchata or jamaica.

Due to rising awareness of health and wellness trends among regional consumers, high sugar content poses a threat to the outlook of the category. The solution, according to Federico Monge from Costa Rica is innovation:

“In the future, concentrate brands have the opportunity to position themselves in a more premium light by introducing variants that highlight functional benefits such as real fruit content, stevia used as a sweetener, or vitamin extracts from curcuma or ginger as well as introducing interesting natural flavours as bases such as coconut, pineapple and passion fruit.”

This is a strategy that can also boost value sales as the category continues to mature and slowing population growth negatively affect its performance.

Quala has also been expanding into other categories, acquiring brands of RTD Tea and aloe vera juice drinks. This is a company expected to disrupt many of these categories for the region based on their aggressive M&A behaviour.

Coffee finds its branding in tradition

In many Latin American countries, there are effects of the third-wave of coffee, a revitalization to the way consumers prepare their coffee at home. According to Jorge Galindo from Guatemala:

“Coffee companies want to bring the café experience to the home. They are drawing on the cultural desire of the Guatemalan people to bring different varieties and flavours of coffee to the home to share with family and guests.”

In the past, most coffee sales in the region belonged to large, established companies who relied on their flagship brands to boast stable growth. Many new brands are entering the market and major producers such as Café Santo Domingo in the Dominican Republic are expanding their portfolio with gourmet offerings and expanded flavour palates, even opening branded coffee shops. In Costa Rica, brands like Café Volio are releasing new SKUs after many years of promoting its staple brand to appeal to a younger consume base.

This idea also pulls from the megatrend “Shopping Reinvented.” As the middle class continues to emerge across the central LATAM region, more consumers will be living on-the-go with a status association with café prepared beverages, which leads us to expect forecasted growth for 3.6% CAGR of coffee foodservice sales across the region.

Flavoured water begins to eat up carbonates’ share

Across the region, there is an explosion of negative press centred around the detriments of drinking sugary beverages. Carbonates are particularly targeted in in these news campaigns. In Guatemala, there have been talks from the government to take away sales of carbonates in primary and secondary schools across the country.

The Mexican government implemented and supported the IEPS sugar tax since 2014 with carbonates top of mind. As a result, across the region we have seen cola carbonates growth slow down over the last three years.

Additionally, cooler summers and more conservative purchasing behaviour of consumers in the region have had an impact on the sales of the soft drinks industry more generally. However, we also see a growth in flavoured water sales in the region of 5.5% in 2018 compared to a global performance of 4.3%.

In markets such as the Dominican Republic, consumers are interested in brightly coloured flavoured water products that find their unique selling point through exotic flavours such as coconut, pineapple, passionfruit, etc.

Some consumers in these countries are shying away from carbonates as their source of hydration because of the negative association with sugar. Instead, consumers are beginning to pick up products perceived as healthier and in this case that means flavoured water brands.

Pictured: Salvavidas saborizada (Guatemala), Fruit (Costa Rica), Premium offering from S.Pellegrino (Dominican Republic)

Central Latin America is in an interesting time period. The soft drink industry is expected to grow by 3.6% CAGR over the next five years and the hot drinks industry is expected to grow by 1.1% CAGR. With the current Mexican administration causing some fluctuation in consumer sentiment and the threats of trade tariffs looming from their North American neighbour, the industry will have many dynamics painting its development over the next five years.

One very important factor that will continue to shape market forces in the region is the growing middle class and on-the-go behaviour as well as the slowdown of population growth which will test the staple brands that have relied on stable growth models and customer loyalty for many years.