This post originally appeared in FocusEconomics. This article was updated on March 8th, 2019, read the updated version here.

With less than two months to go until the scheduled Brexit date of 29th March 2019, the conditions under which the UK will exit the EU remain highly uncertain. The options range from a no-deal Brexit to no-Brexit. The UK’s decision to leave the EU has already taken a toll on the UK economy, but the size of final economic cost of Brexit will heavily depend on the shape of the exit.

All Main Options Remain Possible

After a preliminary EU-UK deal was reached in November 2018, it was defeated in the British Parliament on January 15th by the largest votes margin since 1924. The November UK-EU deal is roughly the only one compatible with avoiding a hard border between the Republic of Ireland and Northern Ireland, avoiding significant internal trade barriers between Northern Ireland and the rest of the UK and regaining control of UK immigration policy (perhaps the main practical objective of leaving the EU).

Its rejection emphasizes the enormous divide between Brexiteers and pro-EU Remainers in British politics. Brexiteers mostly would opt for exiting the EU without a deal by now. Remainers are pushing for a second referendum in hopes of reversing Brexit, or for a Norway Plus deal that would leave the UK in the European Single Market (ESM) and Customs Union (CU) while abandoning the attempt to restrict immigration.

Parliament passed an amendment to avoid No-Deal Brexit on January 29th, but this amendment is non-binding. The UK Brexit secretary has reaffirmed that government policy remains to exit the EU without a deal if no agreement is reached and passed by Parliament by the end of March, the default under Article 50 for leaving the EU.

Parliament also passed an amendment to pursue a revision of the November agreement, especially regarding the Irish back stop for avoiding a hard border between Northern Ireland and the Republic of Ireland. The EU has excluded multiple times any significant revision to the agreement reached with the UK in November 2018, and it is unlikely to change its position.

The Baseline Outlook: A final relationship reached in 2019-2020

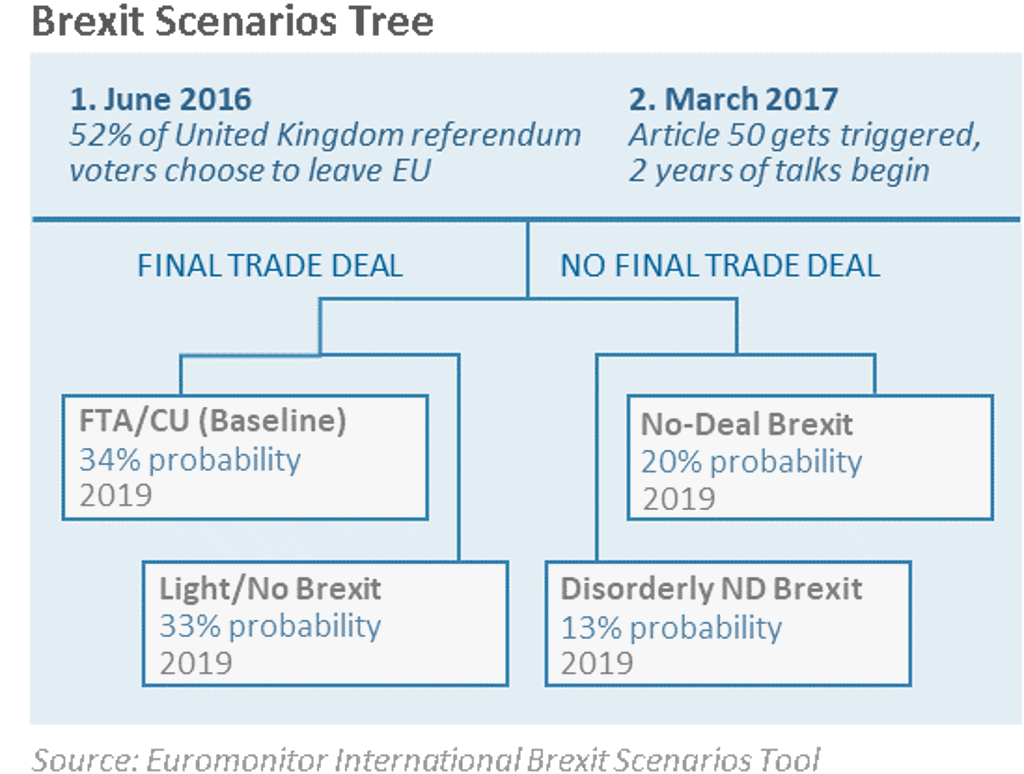

In our baseline forecast, the EU and the UK continue negotiating a final relationship in 2019-2020, using the framework of the November 2018 deal. The UK remains a member of the European Single Market during the transition, but it continues to pay EU contributions while losing any voting rights at the EU. A Customs Union (CU) agreement is likely to be reached in 2020, either under the current Conservative British government or with a new Labour government following elections.

The CU maintains tariff-free trade in goods between the EU and UK. It avoids a hard border between the Republic of Ireland and Northern Ireland, while maintaining an almost frictionless flow of goods, services and people between Northern Ireland and the rest of the UK.

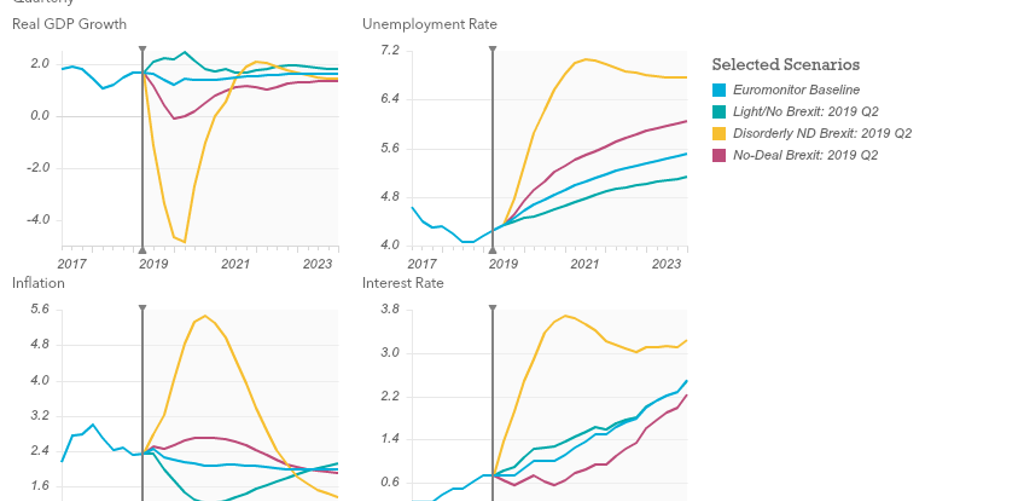

However, the CU leads to significant non-tariff barriers, especially for services. The UK loses its financial services EU passport. UK annual real GDP growth in 2019-2020 is expected at around 1.4%, followed by annual GDP growth of 1.6% in 2021-2025. We assign the baseline scenario a 29-39% probability.

A Light Brexit Remains Possible

Pro-EU factions may still prevail in the British Parliament, leading to the UK targeting a final deal close to Norway’s European Economic Area conditions together with a Customs Union (Norway Plus). Alternatively, the UK letter notifying the EU of its wish to leave the EU could be withdrawn or an extension of article 50 period granted. This allows the UK to hold a new Brexit referendum, leading to a decision to stay in the EU.

In this scenario, the UK retains access to the European Single Market and financial sector passporting rights. UK citizens also retain full EU movement and immigration rights. In exchange, the UK allows free movement of EU citizens.

Business investment recovers from the slow growth in 2016-2018 and consumer spending rebounds. Real GDP growth recovers to around 2% annually in 2019-2020. The level of GDP increases by 1-3% relative to the baseline forecast over 2019-2023. We assign the Light Brexit scenario a 28-38% probability.

Among the Light Brexit options, we see a complete Brexit reversal as less likely. Recent votes have shown there is significant pressure on British MP’s from pro-Leave constituencies against holding a second referendum, and the leader of the Labour opposition Jeremy Corbyn also seems to oppose a second Brexit referendum.

No-Deal Brexit: from bad to worse

In the No-Deal scenario, negotiations between the EU and the UK break down after the British Parliament rejects the November 2018 Brexit deal, and the UK leaves the EU in 2019 without reaching a trade agreement. Trade relations with the EU default to World Trade Organization (WTO) conditions. Overall, we see a 25-41% probability of the UK exiting the EU without a deal in March 2019, i.e. roughly 1/3.

In our main No-Deal scenario, severe trade disruptions last for 1-2 quarters, until UK and EU customs services develop the capacity to handle the massive increase in work volume and complexity. Supply chain disruptions lead to slowdowns in factory production lines. Pessimism about future profits reduces business investment and labour demand.

Consumer spending also declines due to lower wages, higher inflation, higher unemployment and reduced future income prospects. GDP growth declines to 0.8% in 2019 and 0.4% in 2020. Declines in trade and foreign investment reduce long-term labour productivity. The level of UK GDP declines by 2-5% below the baseline forecast in 2019-2023. We assign this scenario a 15-25% probability.

We have also developed a more severe Disorderly No-Deal scenario, given the high level of uncertainty and unprecedented nature of exiting the EU without any alternative trade deal. In this scenario, border disruptions last for 2-4 quarters, trade responsiveness to higher tariffs and non-tariff barriers is stronger than expected and the British economy is hit by significant financial shocks after exiting the EU without deal.

In this case, the UK economy would enter a severe recession, with GDP contracting by around 1.9% in 2019 and 2.1% in 2020. UK real GDP declines by 5-9% below the baseline forecast in 2019-2023.We assign the Disorderly No-Deal scenario an 8-18% probability.

For more detailed Brexit analysis, the Brexit Scenarios Tool examines the impact of different Brexit scenarios on our baseline forecasts for the UK economy, industries and consumers. It offers a range of outcomes, helping businesses to stress-test strategy, plan and remain profitable in these challenging times.

For a more detailed analyses, take a look at our quarterly Brexit Reports or listen to the recent Behind the Data podcast episode ‘Breaking Down Brexit’.