It is happening. The European Union (Withdrawal Agreement) Bill (WAB) was approved by the British Parliament and the European Union (EU) in January 2020 paving the way for the UK to exit the EU on 31st January and enter an 11-month transition period for the remainder of 2020. During this time, the UK will cease to be part of the EU but trading and free-movement relationships between the UK and the EU will not change.

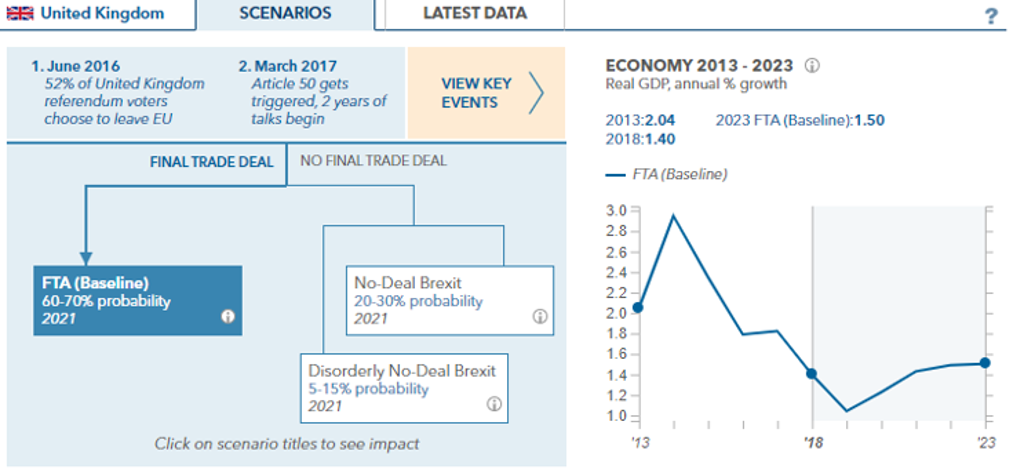

The UK will also have to continue to abide by the EU’s rules but will not be able to influence the decision-making processes inside the union. This development closely follows our baseline scenario which expects to see the British parliament approve a Free Trade Agreement (FTA) with the EU, maintaining tariff-free trade for most goods between the EU and the UK. Relative to the European Single Market, the trade deal would lead to significant non-tariff barriers, especially for services. If this scenario plays out in Q1 2021, we forecast real GDP growth of 1.3% in 2021 overall. We assign a 65% probability to our baseline Brexit scenario.

Source: Euromonitor International Brexit Scenarios Tool

What next?

Prime Minister (PM) Johnson has removed any possibility of extending the transition period from the WAB, setting the UK on the course of either a deal in 2020 or leaving the EU without a deal and entering 2021 on World Trade Organization (WTO) terms. While it is an attempt to strengthen the UK’s negotiating power, an accidental No-Deal scenario cannot be ruled out and became more likely after this amendment of the WAB.

Signing a comprehensive FTA in 11 months might prove to be extremely difficult. There is not a lot of common ground to reach an agreement between the UK and the EU. The EU insists on a level playing field for its markets and, hence, will force the UK to accept trading standards and quality checks on par with the EU ones.

One of the most important disagreement points from a long list is fishing rights in UK waters. PM Johnson wants to take back control of the country’s water rights and, thus, eliminate the current fishing system where EU countries can freely fish in UK waters (subject to environmental considerations under the Common Fisheries Policy). However, EU preparations for negotiations with the UK reveal that the EU would insist on keeping the current fishing system.

Nevertheless, there are possibilities for trade-offs in the area. The EU could exchange improved fishing rights for better access to financial services in the EU for London-based institutions. Financial Intermediation in the UK comprised 7.6% of Gross Value Added in 2019.

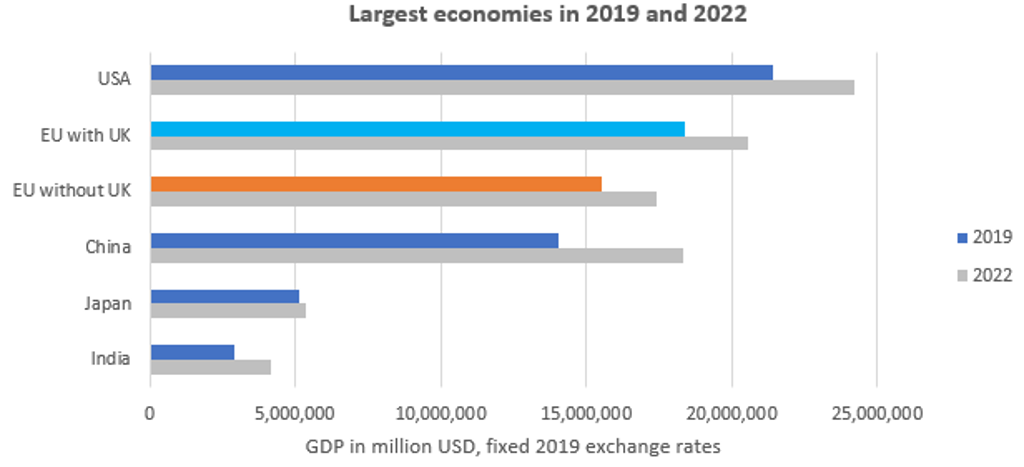

It goes without saying, the EU also loses a significant portion of its economy in the separation. Based on our forecasts, China’s economy in USD terms will surpass the EU without the UK as soon as in 2022.

Source: Euromonitor International from national statistics/Eurostat

Where does Johnson’s deal leave the UK?

PM Johnson’s agreed bill might still create potential divisions within the UK in the future. Not only does the WAB prohibit the UK parliament from asking for a potential extension to the transition period, but it also gives separate status to Northern Ireland, creating a clash between the rules there and in the rest of the UK. Even though Northern Ireland will leave the EU with the rest of the UK, Northern Ireland will continue to abide by European rules for agriculture and manufacturing products to eliminate the need for a physical border between the Republic of Ireland and Northern Ireland.

Additional tensions might also come from Scotland’s disagreement with leaving the EU. Scots voted overwhelmingly to stay in the EU during the 2016 referendum. However, now they are forced to exit the EU together with the rest of the UK. This new development created waves within the Scottish National Party (SNP), which is calling for a new Scottish referendum to leave the UK.

No-Deal Brexit is still possible

If no trade deal or extension is agreed during 2020, the UK will crash out of the EU after 31st December 2020. Therefore, the No-Deal Brexit scenario is still relevant to our GDP forecasts. We give around a 35% probability of the No-Deal Brexit scenario playing out:

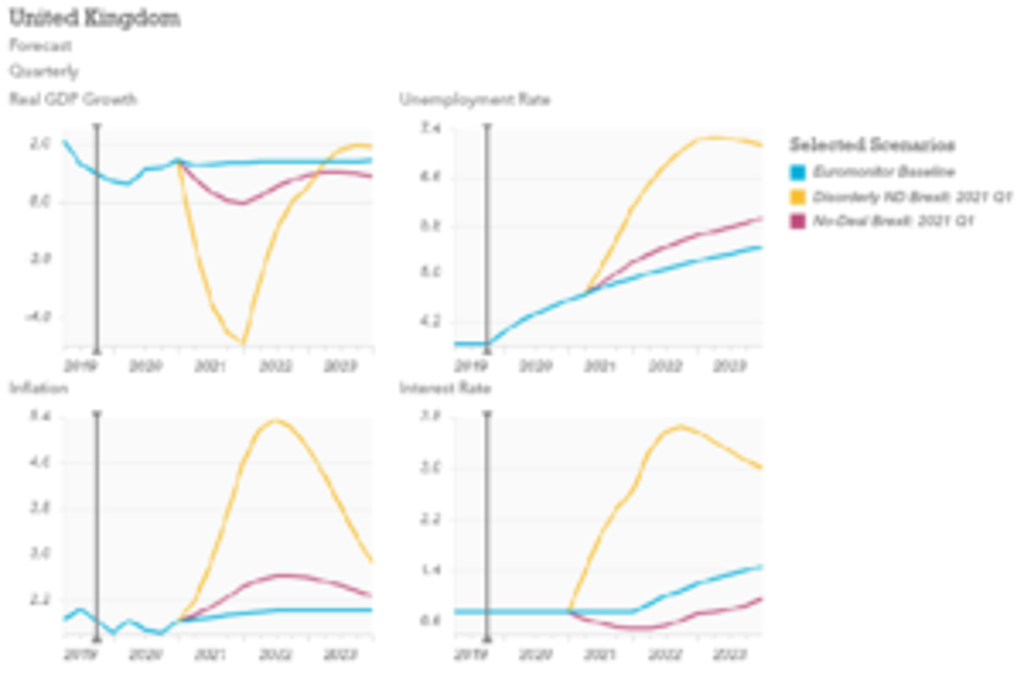

- In our most likely No-Deal Brexit scenario, the UK leaves the EU without reaching a new trade agreement during the transition period. We expect this scenario to play out with a 25% probability. Trade relations with the EU default to WTO conditions with significantly higher barriers. Delays in establishing smooth customs and regulatory controls at the border lead to chaos and shortages of certain goods. Severe disruptions at the border last for 1-2 quarters until UK and EU customs services develop the capacity to handle the massive increase in work volume and complexity. Supply chain disruptions lead to slowdowns in factory production lines. The UK economy grows at 0.3% in 2021 in real terms;

- In the Disorderly No-Deal Brexit scenario, the UK leaves the EU without a trade deal during the transition period. This Disorderly No-Deal Brexit scenario would play out with a 10% probability. Under this scenario, trade relations with the EU default to WTO conditions with significantly higher barriers. Any attempts by the UK to sign new trade deals require lengthy and difficult negotiations. As a result, no significant new trade deals are signed during the first five years after exiting the EU. Delays in establishing smooth customs and regulatory controls at the border lead to chaos and shortages of certain goods in the short-term. Supply chain disruptions lead to slowdowns in factory production lines. In this scenario, the UK economy declines by 3.6% in 2021 in real terms.

Source: Euromonitor International Macro Model

There are still many unknowns. This year is likely to be heavily focused on ironing out all the disputes between the UK and the EU regarding the separation. The path towards a successful and comprehensive deal in 2020 is narrow, but there is a possibility that one will be reached.

Find out more in our Quarterly Brexit Report for Q4 2019.

Euromonitor International’s Brexit Scenarios Tool helps clients to understand the impact of different scenarios on our baseline forecasts for the UK economy, industries and consumers. It offers a range of outcomes, providing the tools to stress-test strategy, plan ahead and remain profitable in these challenging times.