Each year, Euromonitor International reviews everchanging consumer values and priorities that will affect purchasing decisions. Among the trends expected to flourish in 2019, ‘conscious consumers’ and ‘everyone’s an expert’ have a great impact in shaping consumer demand, including their preference for plant-based alternatives.

Conscious consumers seek ways to reduce the impact of their consumptions on the world by being mindful of other human beings, animals, and the environment. As awareness around environmental impacts from livestock increases, alternative meat substitutes are gaining interest in different markets, including Asia.

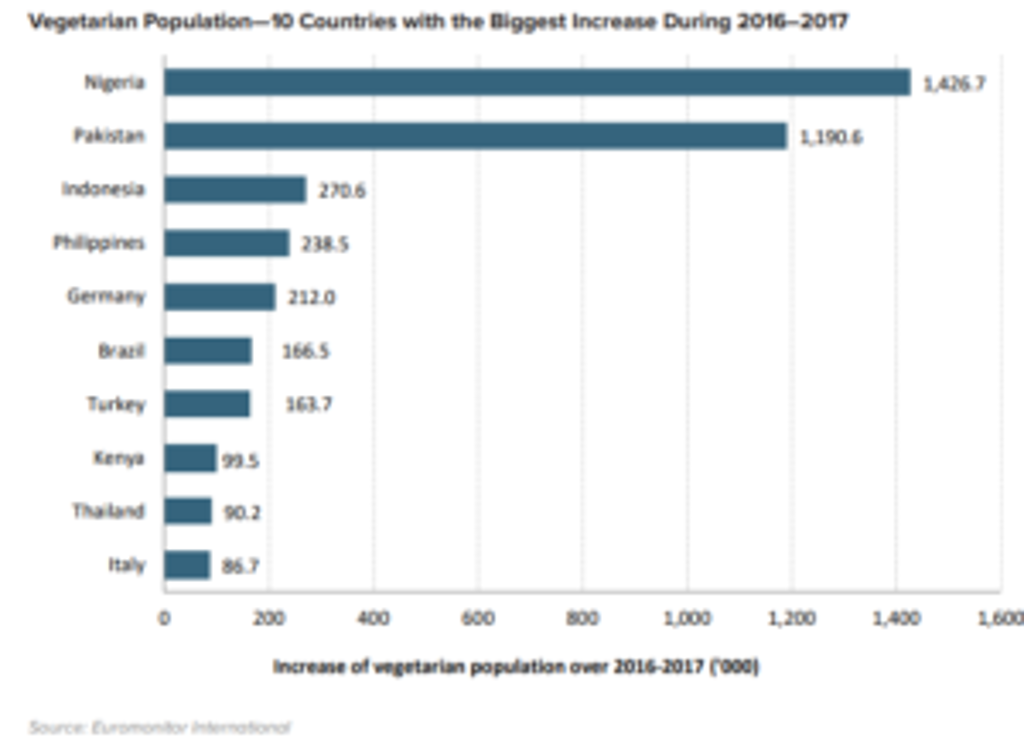

While the growth of plant-based alternatives to meat is often highlighted as coming from the US and Europe, in recent years, Asia has seen a surge in growth of meat alternatives and several Asian countries, including Indonesia, the Philippines, and Thailand are among the top 10 countries with the biggest vegetarian population increase.

Understanding the initial development of the category

Although meat alternatives have existed in the past few decades globally, only recently has interest in meat alternatives hit Southeast Asia, most notably the entry of Quorn to Singapore in 2015. Not only are more vegetarian and vegan eateries appearing in the region, but more restaurants such as 4Fingers in Singapore are also providing vegetarian options to create an inclusive atmosphere. Meat-free menu options are being seen in other 4Fingers outlets in Malaysia and Indonesia as well.

Meat-free dining outlets have expanded from focusing on salads to also include other cuisines, such as burgers, that are highly associated with meat. Vegan burger outlets like Veganburg and Burgreens in Singapore and Indonesia respectively are providing various vegetarian and vegan options for burger lovers.

Support from the government

Governments are also more receptive to the concept of meat alternative product development, supporting the development of local pioneers such as Shiok Meat and Life3 biotech. Singapore serves as a research hub in the region. The Indonesian tourism ministry is trying to push the country as a vegan destination, with close to 500 vegetarian restaurants operating in the country.

Connected consumers are becoming their own experts

The growth in the region was originally pushed by a niche group of vegan and vegetarian consumers. However, connected consumers are becoming experts with a vast amount of information available online. Plant-based products are becoming more visible in both offline and online stores in Singapore. They are among the fastest growing categories in several online platforms, such as Redmart. Additionally, Thailand has been actively developing dairy alternatives including products like Milky Coco, a drinking coconut milk in various flavours.

Meat alternatives have now entered both retail and foodservice channels, especially in Singapore. Through the retail channel, consumers are able to have direct engagement with brands and gather more information about these products prior to purchase.

Foodservice outlets, such as chicken fast food restaurant, 4fingers, and full-service restaurants, Bread Street Kitchen by Gordon Ramsay, have made their move to incorporate international plant-based meat alternative brands like Quorn and Impossible Foods in their menus. Through this menu expansion, they are able to expand their consumer bases to those seeking meat alternatives, while allowing their regular consumers to sample these alternatives, building future demand for the category.

Future opportunities in Southeast Asia

Demand for plant-based alternatives is expected to stay and to expand further in this region, especially with the increase in both vegan and flexitarian consumers. Some packaged food manufacturers have introduced vegan-friendly products, such as DAAI Boga PT that has introduced vegan instant noodle in soto flavour in Indonesia.

With both consumer demand and manufacturers’ push, the category will slowly but surely grow. As earlier challenges of consumer awareness and education on this category being slowly but steadily addressed, consumers are increasingly aware of the health benefits of meat-alternatives.

Other alternatives are currently being developed. This includes the ongoing research into insect protein and algae protein, as well as clean meat produced in vitro. Although these alternatives are yet to be marketed due to limitations in production costs and capability, consumers are increasingly more aware of these future alternatives that may come into fruition in the long term.

For more information download our Healthy Living: Focus on Snacks in Asia Pacific and Cooking in Southeast Asian Kitchens: Innovations in Food and Appliances reports.