As 2020 fades like a traumatic highway accident in our collective rear-view mirror, the alcoholic drinks industry continues to face seismic changes and unprecedented pressures and volatility. However, over the past year, it has also proven that while it might not be pandemic-proof, it is definitely resilient, essential and embracing evolutionary adaptation. As epidemiology, social dynamics, macroeconomic risks and lifestyle choices are combined in a heady cocktail, let us decipher the key trends surfacing for the year(s) ahead, for an industry in a state of flux and -ultimately - cautious optimism.

On-trade: winter has come and the (party) lights at the end of the tunnel

Hospitality sales have, beyond any doubt, been among the pandemic’s greatest casualties.

As the on-trade continues facing its greatest crisis in over a century, a shift to profitability, higher margin offerings, avoiding labor-intensive menus and proprietary ingredients, reduced staffing levels and a nostalgia-infused return to spirit-focused classics will be the largely inevitable strategic decisions in the short term.

Nevertheless, in the medium to long term, the pent-up demand for indulgence, the increasingly desperate need to socialise again and the pendulum of societal traits shifting back towards hedonism after years of fixation with a clinical approach towards health, can lead to a strong bounce back. After all, what followed the great Spanish flu pandemic of 1917 was not a period of mass abstinence but rather an era that is still known as the ‘roaring 20s’.

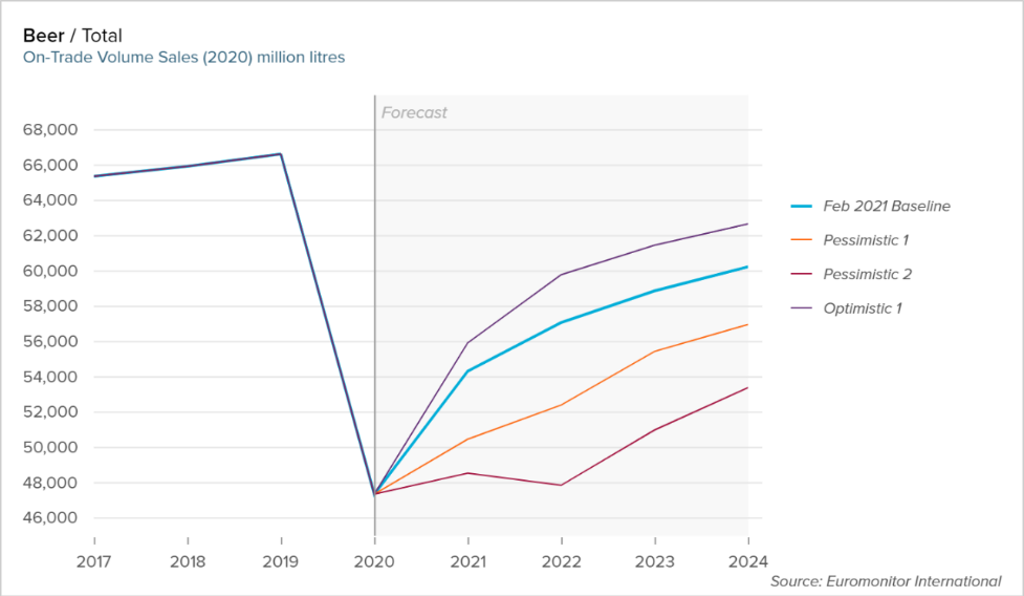

Source: Euromonitor International Alcoholic Drinks Forecast Dashboard

Note: Graph depicts baseline forecasts against a range of Pessimistic/Optimistic COVID-19 scenarios

Non-alcohol democratisation, reaching escape velocity and the limitations of abstinence

The Lo and No Beverage trend has been gradually building momentum – primarily in key Western European markets - for the past few years. From beers to spirits and from sober-curious dedicated events and festivals to dry hospitality venues, such products became intricately associated with the rising wave of interest in health and wellness. The movement culminated in the concept of mindful drinking – an approach that was less about teetotalism and more about lifestyle choices and personal brand curation in the age of social media. Largely aspirational and positioned within premium and above price points, the segment will continue offering opportunities for expanding languishing industry penetration rates while securing solid profit margins through launches, promotional support and – ultimately – consumer interest.

And yet, reports of alcohol’s death have been greatly exaggerated. While there is little doubt that the trend is still in its infancy and the upside potential is indeed present, there is increasingly an element of irrational exuberance and overinflated expectations with regards to its limits.

The near mono-dimensional focus on the high end will soon force participants to face the harsh macroeconomic reality of a post-COVID world. But most importantly, with recovery taking hold, unleashing the collective pent-up demand for indulgence and hedonism could well lead to a loss of cultural relevance and a shift towards psychotropic alternatives rather than teetotalism.

Post-pandemic ripple effects: the dawn of a polarised world

The lack of alternative discretionary spending options, the comparative affordability of key brands sold via retail versus their respective on-trade price points and the stimulus measures providing support in the vast majority of key markets have all been fuelling the much-vaunted premiumisation narrative over the past year. Aspirational consumption and a transition to increasingly more sophisticated (and higher end) varietals and categories has been a key theme for more than a decade so the resilience of the narrative is not surprising and will continue - at least in the short term.

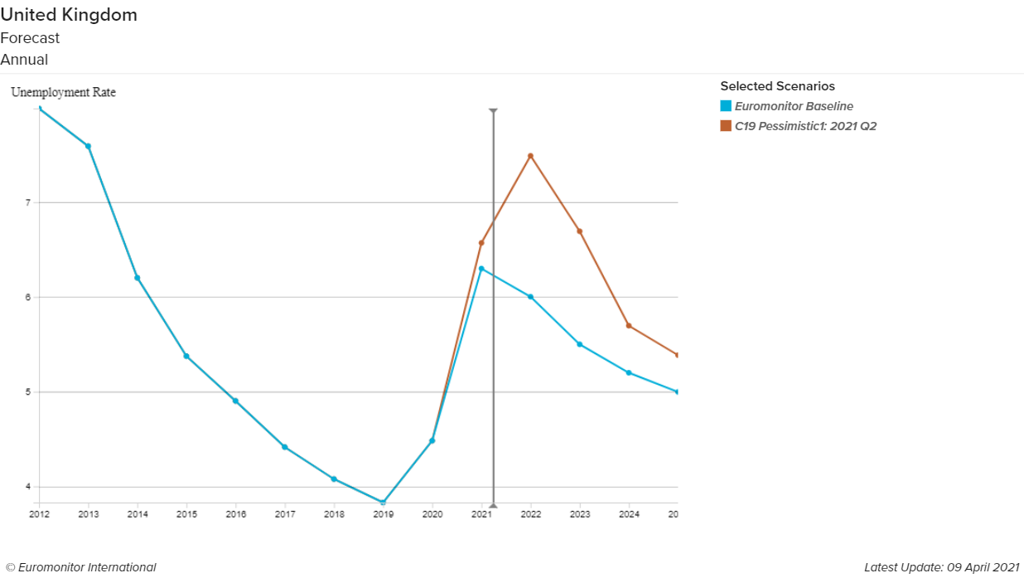

Nevertheless, as discretionary options resurface and expand with the gradual reopening of societies, shopping, hospitality and travel, premium alcoholic drinks will lose their unique positioning as one of the few available lifestyle trading up routes. Additionally, generous and essential stimulus measures will inevitably have to be significantly scaled back or entirely withdrawn, at the same time that unemployment – a lagging indicator – will continue rising higher, as is forecast in the UK.

This is not a macro cocktail that can continue supporting the industry’s almost monolithic focus on premiumisation and more nuanced and diversified strategies will need to be adopted.

Trading down, trading across and polarisation (encompassing renewed vigour for premium varietals alongside a spike in economising and thriftiness with both ends of the spectrum growing to the detriment of mainstream products) will hence replace premiumisation in the medium term.

Forecast unemployment rate in the UK, Baseline and COVID-19 Pessimistic1 Scenario Q2 2021

Source: Euromonitor International Macro Model

Note: In the COVID-19 Pessimistic1 scenario there are 2-3 global pandemic waves in 2021-2022. Global real GDP growth is 2.2-3.8% in 2021 and 1-3% in 2022.