The Coronavirus (COVID-19) pandemic has rapidly accelerated digitalisation in various aspects of life in Western Europe. This became immediately apparent in the payment and banking landscapes with a jump in card transactions due to hygiene considerations and finances managed digitally amid closures of bank branches. This shift was particularly strong in Western Europe’s largest consumer market, the predominantly German-speaking DACH region, consisting of Germany, Austria and Switzerland, with the trend towards digitalisation expected to stay.

While a swift digital transformation in consumer finance is viewed favourably among tech-savvy generations, it also increases the risk of financial exclusion for the large and fast-growing share of older and more traditional consumers in the region. Yet, against this backdrop, businesses can leverage a new market for emerging tech innovations geared towards the needs of older consumers that can help overcome the digital generation gap in consumer finance.

A changed payment and banking landscape

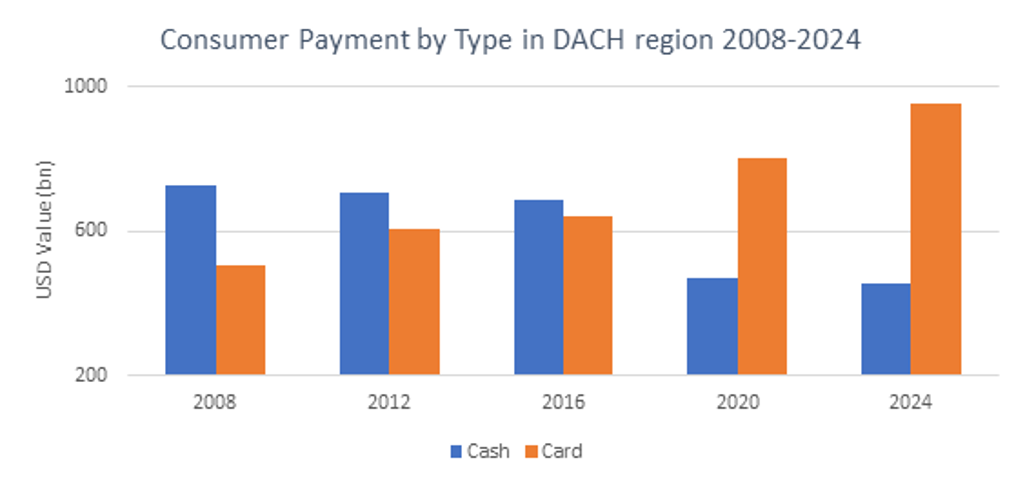

Prior to the COVID-19 pandemic, payment behaviour varied significantly within Western Europe. While countries like Sweden and the UK have already shifted towards card payments since the turn of the millennium, consumer spending in the DACH region has remained largely conservative. In 2017, between cash and card transaction value, cash payments accounted for 50% of transaction value in the DACH region compared with only 21% in the UK. Cash payments have been declining in the DACH region but the pandemic has led to an even more significant and abrupt shift in payment behaviour compared to countries where card transactions were already widespread.

Fuelled by merchant recommendations to mitigate the spread of COVID-19, there is rising usage of contactless technology via payment cards and mobile devices. Although a trend which emerged before the pandemic, through its catalytic effect, it is expected to result in permanently changed preferences from 2020.

Source: Euromonitor International. Note: Data from 2020-2024 are forecasts

With bank branches closed due to government-imposed lockdowns, banking services rapidly turned digital driven by video advisors and artificial intelligence capabilities such as chatbots. A growing share of customers have used online banking regularly to manage their finances since the pandemic or have even shifted to innovative digital mobile banks like N26.

Traditional banks, such as Germany’s largest retail banks Deutsche Bank and Commerzbank, have responded by driving forward plans to significantly downsize their network of physical branches. Consequently, the banking landscape has seen an immediate impact and a permanent change resulting from the pandemic.

Older consumers at risk of financial exclusion

The rapid digital transformation of the payment and banking landscapes pose significant challenges to the large share of older consumers in the DACH region. On balance, this age group prefers cash transactions which are viewed as the most secure payment method with the highest control over spending. In Germany, for instance, Euromonitor International’s 2020 Digital Consumer Survey revealed that just 31% of baby boomers (born between 1946-1964) trust international card operators like Visa and Mastercard to process their payment details and only 10% trust tech companies like Google and Apple. Moreover, physical bank branches are preferred to withdraw cash and to utilise face-to-face customer service.

Consequently, with declining numbers of brick and mortar banks and diminishing relevance of cash payments, older consumers are increasingly at risk of financial exclusion, particularly in view of limited digital and financial literacy. This development underlines the digital generation gap in consumer finance and highlights the need for long-term solutions.

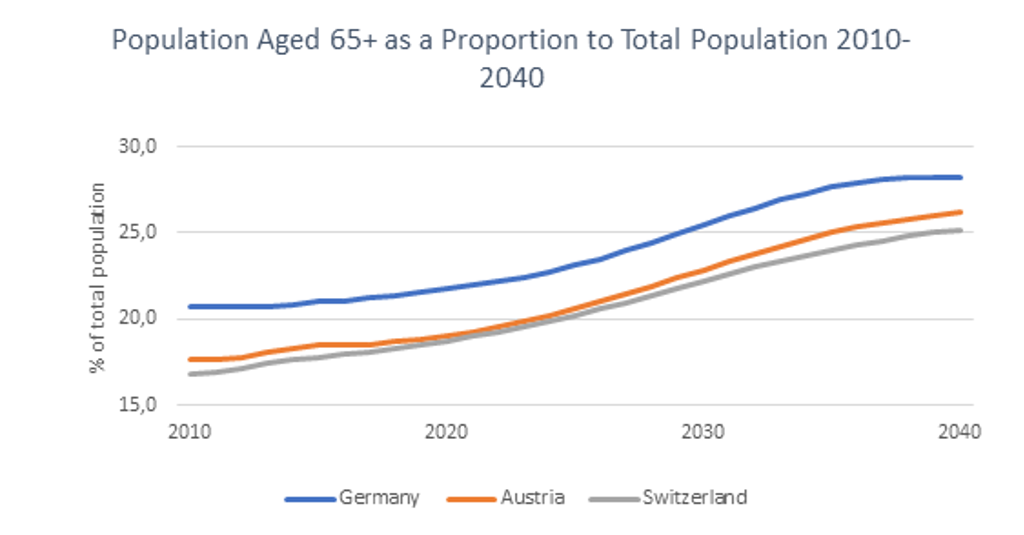

That is because in the DACH region, population ageing is the most significant demographic change that drives its consumer market. By 2040, more than a quarter of the population in all three countries will be aged 65 and over, compared to a fifth in 2019.

Source: Euromonitor International from national statistics/UN. Note: Data from 2020 are forecasts.

“Age tech” as a new market opportunity

Innovative technology can offer user-friendly solutions that take into account the customer’s age and capabilities. Through the use of augmented reality, virtual reality and voice-activated payment technology, particularly in the context of the Internet of Payments (IoP), businesses can leverage the increasing demand for innovative products and services that address the requirements of older consumers aiming to independently manage their finances.

Still in its infancy, this new market for “age tech” provides considerable potential considering the demographic projections not only for the DACH region but also other ageing populations globally. This is further supported by growing experience and higher acceptance among older consumers of digital products and services as a result of the COVID-19 pandemic.

The accelerating digital transformation of the payments and banking landscapes has shown that financial inclusion is increasingly driven by technological innovation. Thus far, this development is largely geared towards the needs and expectations of tech-savvy millennials without considering the widening gap to the growing share of older consumers. Given their proportion of the population, spending power and special requirements, it will be critical to include this group in the digital age, not only to avoid widespread financial exclusion but also to benefit from an emerging market opportunity.

Learn more:

Briefing: Ageing Consumers and Digital Finance: A New Market in the DACH Region after Coronavirus

White Paper: The German Consumer: Rapid Evolution Amidst the Crisis