Manchester City FC dominated the headlines recently. Another league title in the trophy cabinet, the result of a strong latter half to the season, the club winning its last 14 games a row to overcome Liverpool by a solitary point in what was a record-breaking season. The club also secured a first-time ever domestic treble in English Football, claiming the FA Cup on top of the already won Premier League and Carabao Cup earlier this year.

However, the club also made headlines for negative reasons. Tensions with UEFA over Financial Fair Play (UEFA FFP) breaches and misconducts have followed the club since 2014 and they might come true over the next weeks.

The UEFA FFP regulations were introduced with the 2011-12 season for all of Europe. They were established to prevent football clubs spending more than they have earned and getting into financial problems that might endanger their future. Also, FFP rules set out clearly the sources of revenue and expenses for European clubs, limiting the constant pouring of cash from wealthy owners that eventually unbalanced European football in the late 2000s and threatened the fairness of UEFA competitions.

Breaching the UEFA FFP could result in fines, withholding UEFA competition revenues, point deductions for the domestic league, prohibition on registering new players for UEFA competitions, restrictions on the number of players registered for UEFA competitions and possible disqualification from future UEFA competitions – all sanctions that Manchester City will possibly have to face.

While Manchester City may find itself in UEFA’s crosshairs, it is worth zooming out and looking at the performance of the team, as well as of its rivals, to understand the wider context and look at how UEFA FFP has evolved between 2017 and 2018.

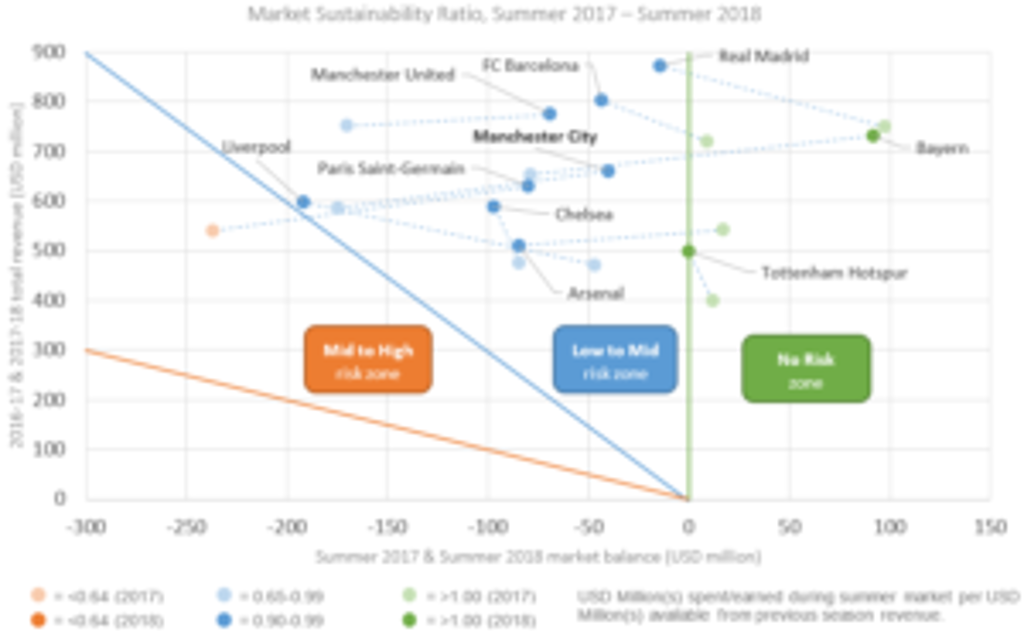

A comparison of the revenue/transfer expenditure ratio after the summer 2017 and the summer 2018 transfer windows shows that the top 10 clubs by total revenue in the world have overall improved their spending behavior.

Compared to 2017, in 2018 less teams had a positive market sustainability ratio – when the club’s market balance is ultimately positive. While in 2017 four teams were in the No Risk zone, only two had a positive ratio in 2018.

At the same time, more teams were closer to break-even in 2018 than in 2017. No teams in 2018 found themselves in the Mid-to-High Risk zone and in general most teams have shifted right towards the safer part of the Low-to-Mid Risk zone.

Manchester City has improved its market sustainability ratio, but perhaps not to UEFA’s satisfaction. Considering the lengthy period in which the club was deemed to be breaching regulation and the accusations of having deceived over USD60 million expenditure from UEFA’s controls, it may have to fight to retain its place in the 2020 Champions league.

Manchester City’s case shows how top football teams in Europe will have to tread carefully with their spending behavior. Since FFP infringements are calculated across several seasons, during the first years of implementation several clubs carried accumulated debts, which ultimately forced UEFA to exercise leniency at first with non-compliant clubs (of which there were many) which brought the efficacy of FFP into question for critics.

But, as the 2018-19 season wraps up, the UEFA FFP (implemented eight seasons ago) is now firmly established. Clubs can no longer justify their imbalances with past mistakes. The challenges facing top-flight football continue to grow. Competing at the highest levels is becoming increasingly expensive, and clubs will need to ensure that revenue sources are fully maximized to enjoy sufficient spending power, a necessity in order to to excel in European football.