A version of this article originally appeared on Perfumer & Flavorist.

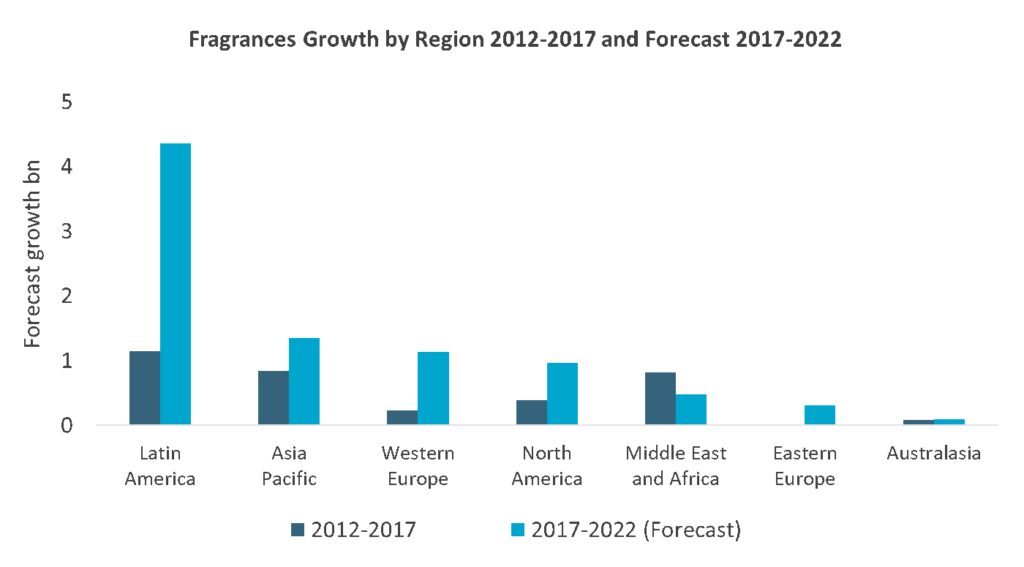

The global fragrances market enjoyed another positive year of growth. In 2017, retail sales grew 5.5%, amounting to USD49.3 billion, with a 6.3% compound annual growth rate expected from 2017 to 2022, according to Euromonitor International.

Source: Euromonitor International

Premium keeps driving value growth in most markets

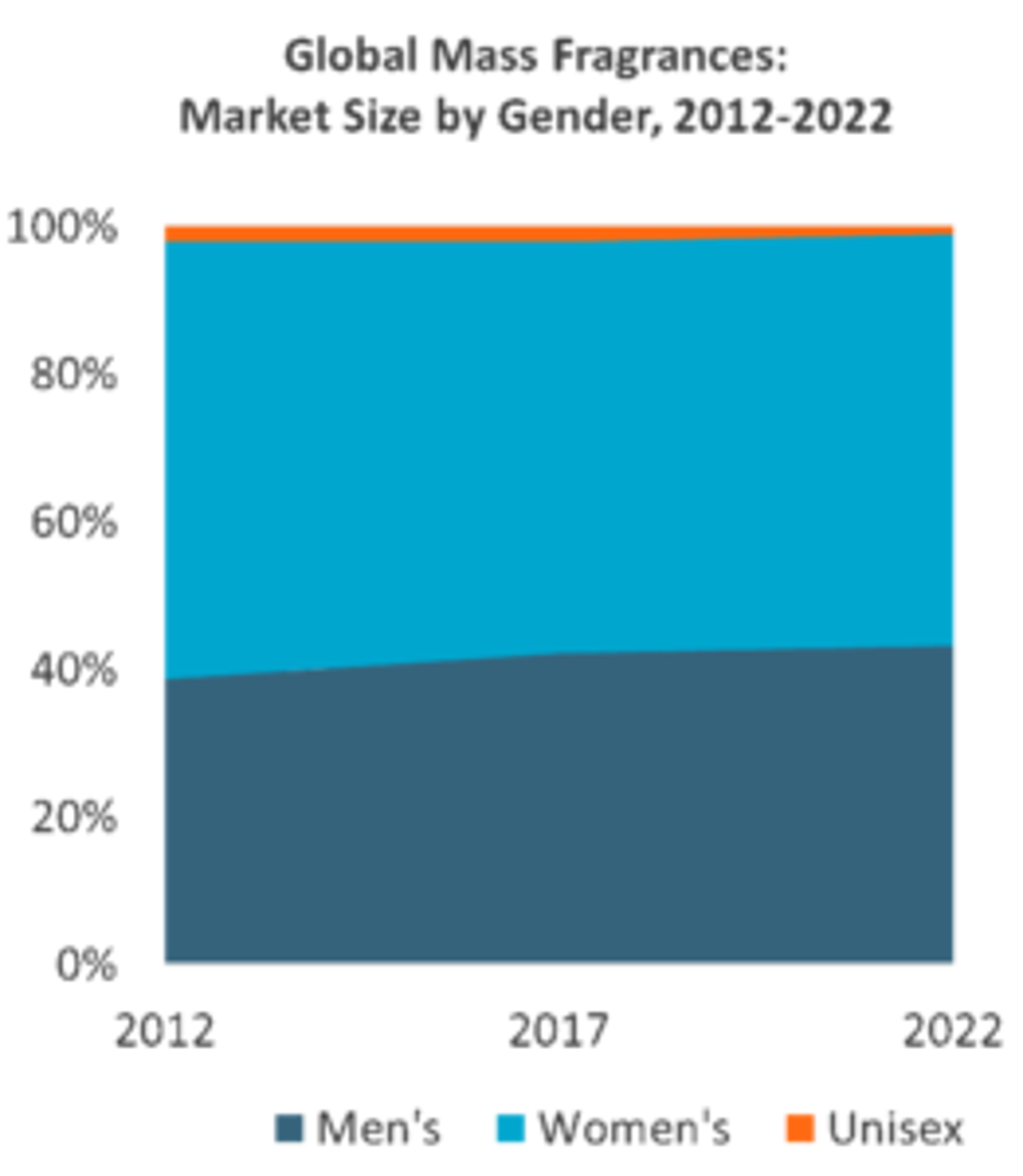

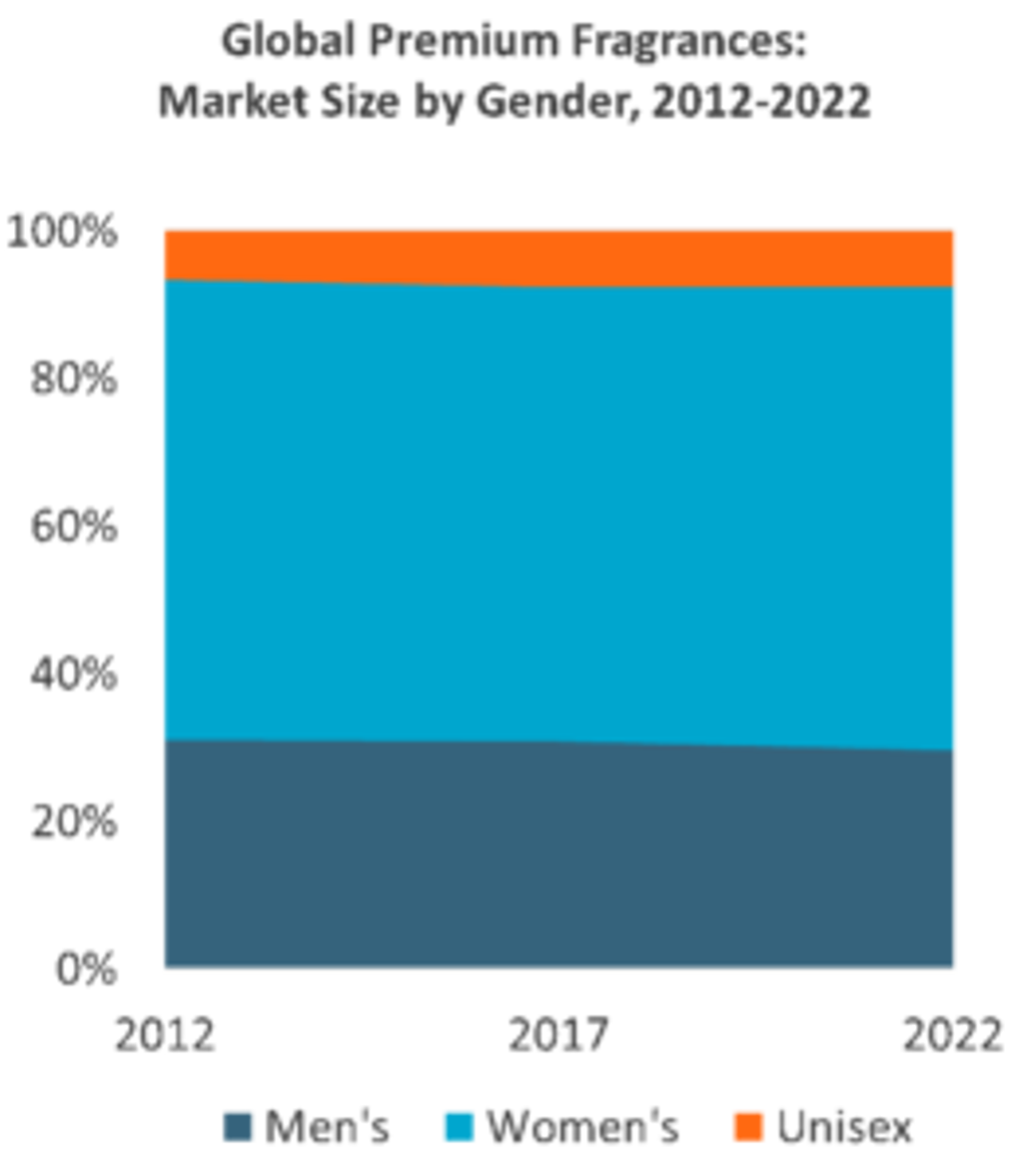

While growth is positive across the category, it is unequally distributed among mass and premium segments. Across most regions, the premium segment is expected to grow faster than the mass segment, retaining the majority of sales in most markets apart from Latin America and Eastern Europe where the mass market is growing faster, according to Euromonitor. The demand for premium fragrances has bright days ahead, but traditional brands (especially luxury designer brands) will need to adapt to face the growing competition from niche and “indie” players. The fragrance industry is now embracing broader beauty and personal care trends and adapting better to new consumer demands, not only in terms of distribution but also in terms of product offering.

Source: Euromonitor International

Back to simplicity

The fragrance industry is going back to basics, stripping away unnecessary ingredients to deliver raw, cheaper and tailored products. American brand Ostens recently released five products, which it describes as “preparations”, focusing on one ingredient per preparation that can be layered and tailored for and by consumers. The brand Escentric Molecules tapped into this personalization segment in 2006, offering fragrances containing the Iso E Super aroma-molecule, which adapts to the skin of consumers wearing it. Going forward, the industry will keep embracing and exploring the raw aspects of fragrances, which will help establish a sense of uniqueness to consumers with the additional appeal of cleaner ingredients.

Growing demand for cleaner alternatives

Consumers are living busier lifestyles; being mindful and careful of one’s general wellbeing are now priorities for many. Fragrances bring a specific sense of wellbeing and empowerment, often perceived as uplifting, accompanying consumers from the start to the end of their day. However, consumers are paying more attention to the ingredients in their skin creams and makeup, and fragrances are no exception. According to WebMD, fragrances were the leading cause of skin inflammation in the US. The industry is still behind when it comes to clean fragrances and using hypoallergenic ingredients.

Skylar, an American brand, is bringing vegan and free-from fragrances to consumers, composed of natural oils and organic sugar cane alcohol. British brand Awake Organics recently launched natural vegan perfume oils in a set of two, designed to be worn separately or layered together, “depending on the mood, occasion or preference”, according to the brand’s founder. The brand claims to have been formulated with mood-enhancing herbs, wild-crafted resins and essential oils with no added color or synthetic fragrance. The brand also suggests that consumers take a moment to “pause, breathe and channel their energy”, according to the brand’s founder.

Potential in retail to offer more immersive experiences

The fragrances category has a competitive advantage with the opportunity to develop concepts around sensory experiences. Brands are embracing this, and Diptyque, for example, uses pop-ups to engage directly with consumers in physical retail. More traditional retailers such as The Fragrance Shop in the UK are offering “sniff bars”, blending physical and digital to shop for fragrances, where consumers can chat with shop assistants in-store but also via live chat or email. French brand Juliette Has a Gun created a fragrance café in partnership with digital start-up Paperscent offering personalized samples to consumers, presenting a more immersive experience into the brand’s DNA. Subscription services are also a new way for companies to bring brands directly into homes. Companies such as Scentbird or Sniph are allowing consumers to discover new fragrances in the comfort of their own homes with smaller pack sizes and cheaper prices.

Addressing future needs

The main challenge for fragrances will be the growing reluctance from consumers to commit to one fragrance, allowing them to mix and match, similar to their colour cosmetics or skincare. Consumers desire different formats and sizes to tailor to their specific needs. The industry will also have to adapt to new lifestyles as consumers grow more mindful of their environment and more conscious of the products they introduce on their skin.